Managing your business's finances is like steering a ship – ensuring you have enough wind in your sails while charting a clear course.

That's where working capital management comes in.

It's not just a numbers game – it's the key to smooth operations and steady growth.

From cash flow forecasting to efficient inventory practices, we'll show you how to keep your financial engine running smoothly.

Get ready to boost your business's financial health with practical working capital management strategies and actionable steps.

Let's start!

Working capital is like your business's financial cushion once all the immediate bills are taken care of.

Simply put, it's the difference between what you own (like cash, stocks, and inventory) and what you owe (such as salaries, taxes, and other payments) in the next twelve months.

Business liquidity, closely intertwined with working capital, signifies the business's ability to quickly convert its assets into cash and meet its immediate financial obligations.

A well-balanced liquidity position ensures you can continue operating without disruption, regardless of external economic fluctuations or unforeseen challenges.

Efficient working capital management is essential for maintaining financial health and operational agility.

There are numerous working capital management strategies you can use, so let's explore them in more detail:

Forecasting and planning future cash flows is crucial for effective working capital management.

By analyzing historical data and considering various scenarios, you can anticipate cash inflows and outflows and make informed decisions about spending, investment, and resource allocation.

Balancing inventory levels is critical to avoid tying up excess capital or facing shortages.

Adopting efficient inventory management techniques, such as just-in-time (JIT) inventory or using technology for demand forecasting, can help optimize inventory turnover, minimize carrying costs, and ensure products are available to meet customer demand.

Whatsmore, you should also use inventory tracking software that employs advanced algorithms and data analytics to monitor inventory levels, demand patterns, and reorder points.

Streamlining credit policies and managing outstanding invoices are essential for maintaining a healthy cash flow.

Implementing credit checks on customers, setting appropriate credit terms, and following up on overdue payments can reduce the risk of bad debts and ensure a steady cash inflow.

Negotiating favorable payment terms with suppliers can extend your time to pay for goods and services, improving your cash flow.

Here are some strategies to consider:

1. Early Payment Discounts

Negotiate with suppliers to offer early payment discounts for settling invoices before the due date. This can incentivize you to pay early and secure cost savings while suppliers benefit from improved cash flow.

2. Extended Payment Terms

Work with suppliers to extend the standard payment terms.

It will give you more time to convert inventory into sales and collect payments before settling your payables.

3. Volume Discounts

Request volume-based discounts for purchasing larger quantities of goods or services, which can lead to cost savings and increased buying power, benefiting both parties.

4. Consolidated Purchasing

If you work with multiple suppliers offering similar products, consider consolidating your purchases to fewer suppliers.

This approach can provide leverage for negotiation and lead to better terms.

5. Supplier Financing or Vendor Managed Inventory (VMI)

Explore options for supplier financing, where your suppliers provide financing for your purchases or manage inventory on your behalf.

6. Negotiate Payment Schedules

Negotiate staggered or flexible payment schedules that align with your cash flow cycle.

As a result, it will help smooth out cash outflows and reduce the impact on your working capital.

7. Alternative Payment Methods

Explore alternative payment methods, such as electronic funds transfers or invoicing, which may offer cost savings or efficiency improvements for you and your suppliers.

8. Benchmarking and Market Analysis

Research the market and benchmark supplier terms against industry standards to get negotiating leverage and help you make better decisions.

Tightening expense controls is a savvy working capital management strategy that involves carefully managing and reducing unnecessary costs within your business.

Here's a step-by-step guide on how to do it:

1. Conduct a Comprehensive Expense Analysis

Begin by thoroughly reviewing all your business expenses, both fixed and variable. Categorize them into essential and non-essential costs. This analysis will provide a clear picture of where your money is going and where is the saving potential.

2. Identify Cost-Cutting Opportunities

Scrutinize each expense category to identify areas where cost-cutting is feasible.

Look for redundant or unused services, renegotiate contracts with suppliers, and explore opportunities to optimize resource utilization.

3. Set Clear Expense Reduction Goals

Establish specific and achievable expense reduction goals.

Whether it's a percentage decrease in specific expense categories or an overall reduction target, having clear goals will help guide your efforts.

4. Prioritize Essential Spending

While cost-cutting is the objective, be cautious not to compromise essential operations or services. Prioritize spending that directly contributes to revenue generation or customer satisfaction.

Focus on optimizing the various components of the working capital cycle, such as reducing the time it takes to convert raw materials into finished goods and cash.

Shortening this cycle enhances liquidity and accelerates cash inflows.

Let's see how it can enhance your business's performance:

✔️ Efficiently sourcing raw materials is the first step in the cycle.

Negotiate favorable terms with suppliers, ensure timely deliveries, and minimize lead times to reduce the time between ordering raw materials and their arrival at your facility.

✔️ Implement lean manufacturing practices to minimize waste, reduce production cycle times, and improve the efficiency of converting raw materials into finished goods.

✔️ Streamline your inventory management to strike the right balance between stock levels and customer demand.

Excess inventory ties up capital and incurs storage costs, while insufficient inventory can lead to stockouts.

Additionally, optimizing inventory levels ensures products are available to meet customer needs without unnecessary capital tie-up.

✔️ Accelerate the sales process by implementing effective sales strategies, such as offering prompt payment incentives or discounts for early settlement.

Efficiently manage accounts receivable by sending timely invoices, following up on outstanding payments, and minimizing the time between sales and cash receipts.

✔️ The final stage is the conversion of accounts receivable into cash.

Shorten the cash collection period by offering convenient payment options, implementing automated payment processes, and maintaining open communication with customers regarding payment expectations.

As cash cycles through your operations more quickly, you can cover short-term obligations, invest in growth initiatives, and capitalize on business opportunities.

The technology optimizes working capital management through tools and solutions that enhance efficiency, accuracy, and decision-making.

Cash Conversion Efficiency (CCE) is a crucial metric that measures how effectively you can convert your investments in inventory and other resources into cash flow from sales.

A higher CCE indicates efficient cash flow management and better working capital utilization.

Let's consider two retail companies, Company A and Company B, operating in the same industry.

Both companies have similar revenue and cost structures. However, their cash conversion efficiencies differ significantly.

In this example, Company A has a higher cash conversion efficiency than Company B.

This suggests that Company A is more effective at converting its sales into cash flow, indicating better working capital management and operational efficiency.

On the other hand, Company B has a lower cash conversion efficiency, which might indicate room for improvement in managing its working capital and cash flow.

💡The example illustrates how analyzing cash conversion efficiency can provide insights into a company's working capital management effectiveness.

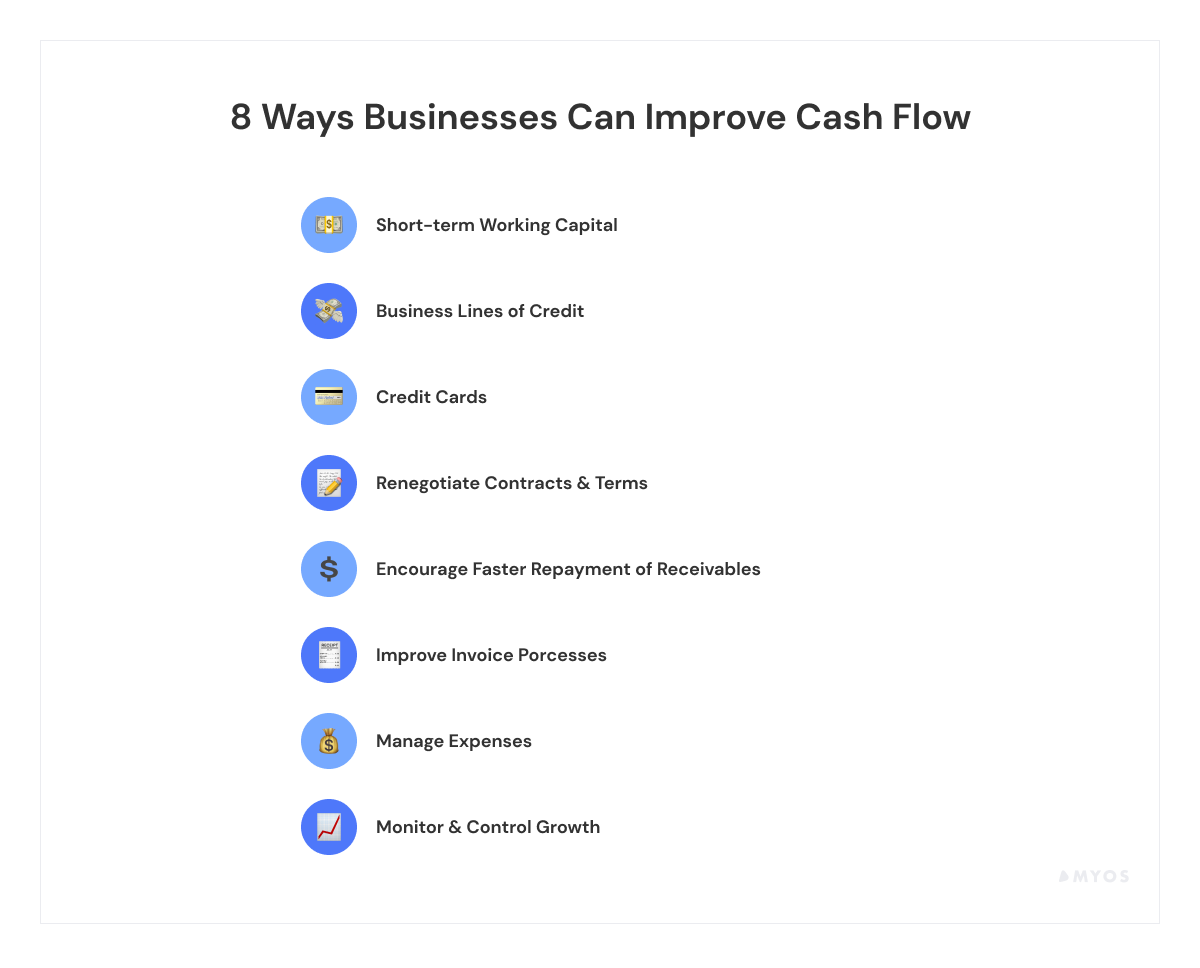

Receiving adequate financing is one of the most essential working capital management strategies to ensure smooth operations, seize growth opportunities, and manage short-term financial needs effectively.

Asset-based financing emerges as a quick and low-risk solution when your small business requires swift access to funds for various needs.

It is especially relevant for many ecommerce stores that may lack an extensive business history, documentation, or established credit to qualify for conventional financing avenues.

The ecommerce industry is flourishing globally and seeking more funding options.

Asset-based financing is gaining popularity as an alternative source.

Partnering with Myos eliminates the need for a personal guarantee, and instead, the borrower shares the risk collaboratively. This approach tackles the reservations that often come with traditional financing routes.

Here's how receiving additional financing contributes to working capital management:

Develop a plan for liquidating non-essential assets in case of severe liquidity challenges.

It involves selling surplus inventory, equipment, or other assets to generate immediate cash.

Here's how it works:

Aligning your business with sustainable practices offers financial benefits and operational efficiencies. Seamlessly weave sustainability into your working capital management through:

Effective working capital management strategies are the foundation for ensuring lasting success in the business world.

Striking the right balance between having enough cash and making a profit is like building a solid financial base that leads to resilience, efficiency, and steady growth.

In the fast-paced world of online commerce, businesses often need extra money to make the most of opportunities and overcome challenges.

That's why Myos offers a specialized approach, making lending decisions swiftly and giving business owners the power to keep control while accessing the funds they need to nurture their ventures.

So, what can you anticipate from Myos?

🎯 Our loan offerings range from €10,000 to €2,500,000 without necessitating personal guarantees.

🎯 Your goods serve as collateral, and the financing amount is based on their present market value.

🎯 You have the flexibility to modify payment schedules without any additional fees.

🎯 Our application process is swift and user-friendly, ensuring a rapid response time.

🎯 We stand as a dependable financial partner, wholly dedicated to fueling your expansion.

So, sign up today and get a free, non-binding offer!

11 Ecommerce Cash Flow Management Tips

8 Inventory Management Strategies To Improve Your Business (With Formulas and Examples)

Operating Cash Flow vs Free Cash Flow - What’s the Difference?