Cash flow forecasting is not just for finance experts.

It's an indispensable financial tool that every business owner or manager should understand.

An accurate cash flow forecast provides a clear picture of how cash moves in and out of a company, helping in planning, decision-making, and maintaining financial stability.

But the best thing is that you can do it yourself, with a bit of help from our side.

This comprehensive guide will show you how to do cash flow forecasting,break down the fundamentals, walk you through the steps, and provide detailed examples to make the process accessible to everyone.

Understanding the importance of cash flow forecasting is like having a superpower for financial stability and effective cash management in business finance.

Think of it as your financial GPS, guiding businesses away from cash shortages that can lead to trouble.

Cash flow forecasting is essential for several reasons:

✔️ It allows you to anticipate when you'll have surpluses and shortfalls of cash, thus knowing when to spend, save, or invest.

✔️ Cash flow forecasting is critical for managing day-to-day operations and preventing liquidity crises.

✔️ This early warning system allows you to proactively address problems, such as seeking additional financing, renegotiating terms with suppliers, or cutting costs.

✔️ Lenders, investors, and stakeholders often require cash flow projections to assess a business's financial health and viability.

✔️ Use cash flow forecasting to plan your debt repayment schedules and ensure timely payments.

✔️ When you know when to expect cash inflows and outflows, you can make tax payments and allocate resources for tax obligations more effectively.

✔️ You can identify and rectify inefficiencies in your operations (like optimizing inventory management, negotiating better credit terms, or streamlining production processes).

✔️ Accurate cash flow forecasts can help prepare for unforeseen events like economic downturns, natural disasters, or health crises and implement contingency plans.

Collecting all the financial puzzle pieces is crucial in the first leg of our journey to effective cash flow forecasting.

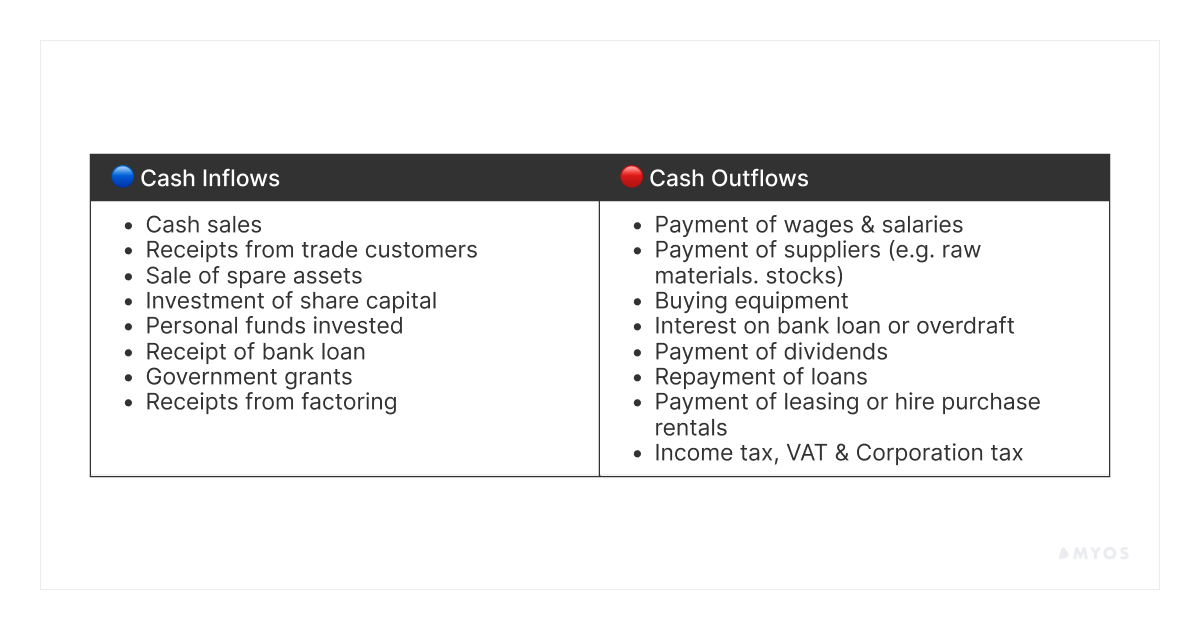

Look back at historical cash flow analysis, scrutinize your financial records, and meticulously categorize your cash inflows and outflows.

For example, your cash inflows might encompass:

While your outflows could include expenses such as:

Historical data provides invaluable insights into patterns and trends, helping you anticipate future cash flows more accurately.

Imagine this step as laying the groundwork for a skyscraper; the more solid and comprehensive your data collection, the higher you can build your financial forecast confidently.

Now that you've compiled your financial treasure trove, the next phase involves sorting and categorizing your cash flow sources and expenses.

First, categorize your cash inflows. By organizing these sources, you better understand where your money comes from.

On the flip side, identify and categorize your cash outflows.

This entails distinguishing between operating expenses, such as salaries, rent, and utilities, and capital expenditures, like equipment purchases or office renovations.

Correctly categorizing these expenses helps you pinpoint where your money is going.

The next checkpoint in your cash flow forecasting expedition is to define the timeframe for your financial forecast.

📌 Short-term forecasts typically cover a few weeks to a few months and are valuable for day-to-day financial management.

📌 Long-term forecasts extend over several months to years and are crucial for strategic planning and investment decisions.

Moreover, decide whether you need a weekly or monthly forecast based on the pace of your business operations.

A weekly forecast is like a magnifying glass, offering granular insights into your finances, while a monthly forecast provides a broader overview.

You have two primary methods regarding cash flow forecasting: direct and indirect. Each method is tailored to suit different forecasting periods and objectives.

✨ Suppose you're running a small cafe and want to predict your cash flow for the next month to ensure you have enough cash to cover weekly expenses like rent, salaries, and ingredient purchases. In this case, you'd likely opt for direct forecasting as it's suitable for short-term, cash-based predictions.

✨ Consider a medium-sized manufacturing company planning its annual budget.

It needs to project cash flow for the entire fiscal year, considering not just cash transactions but also future revenues, expenses, and assets.

In this scenario, indirect forecasting based on accrual accounting would be the more appropriate choice.

As you continue your journey in cash flow forecasting, it's time to calculate your opening balance and project your cash inflows.

This is the cash on hand at the start of your forecast period.

It's your baseline and sets the stage for the journey.

To determine this, take the cash balance from your last financial period or use the final balance from your historical data.

This often starts with estimating your sales revenue. You can use historical sales data and factor in any growth or seasonality.

For this part, you need to analyze your accounts receivables. Consider how quickly customers typically pay you.

In this step, you've calculated your starting point (opening balance) and projected cash inflows (sales revenue and accounts receivables).

This helps you set the stage for a comprehensive cash flow forecast, ensuring you have a solid foundation and a clear map for your financial journey.

In this critical phase of cash flow forecasting, we'll focus on estimating your projected cash outflows while monitoring potential risks or disruptions.

Begin by categorizing your expenses, which typically fall into two main categories:

%20(1)%20(1).png)

A crucial aspect of cash flow forecasting is anticipating potential risks and disruptions. Here are some elements to consider:

A fictitious restaurant, "Tasty Bites," illustrates how to prepare a monthly cash flow forecast for May 20XX:

1. Determine the Forecast Period: Tasty Bites plans to create a cash flow forecast for May 20XX in this scenario.

2. Break the Forecast into Smaller Periods: Tasty Bites has weekly expenses and revenue, so the forecast is broken down into weekly segments for better accuracy.

3. Identify Expected Cash Inflows:

4. Plot Cash Receipts:

5. Identify Expected Cash Outflows:

%20(1)%20(1)%20(1)%20(1).png)

6. Plot Cash Payments

7. Calculate Net Cash Flow: Subtract cash outflows from weekly inflows to determine the net cash flow. Analyze weekly results; some may be positive and others negative.

8. Sum Net Cash Flow: The sum of net cash flow from each week provides the overall positive or negative cash flow for May 20XX.

💡 In this example, the forecasted cash flow for Tasty Bites in May 20XX is positive, amounting to $4,500.

Adding this to the opening cash balance of $3,000 on May 1, 20XX, the projected closing cash balance on May 31, 20XX, is expected to be $7,500.

%20(1)%20(1)%20(1)%20(1).png)

How To Enhance Your Cash Flow Spreadsheet

Remember: a cash flow forecast is more than just a one-and-done task. It's a dynamic, functional business tool requiring regular monthly reviews and updates.

While forecasts serve as helpful guides, they can't perfectly foresee the future.

Over time, you will likely notice disparities between your projections and actual results.

When this happens, it's time to recalibrate your forecast to account for these variations.

To enhance the precision of your cash flow worksheet, consider the following:

Hopefully, this guide helped you in understanding how to do cash flow forecasting and its importance of guiding your business toward stability.

A consistent cash flow ensures that your business operations continue smoothly by allowing you to meet your daily financial obligations.

A dependable cash flow also provides a safety net for unexpected expenses and opens doors to expansion and growth opportunities.

However, maintaining a consistent cash flow can be challenging. This is where cash flow loans can be helpful.

Opting for a cash flow loan can offer a vital financial boost when a business needs it most.

It can bridge temporary cash shortages, fund essential projects, or capitalize on growth opportunities.

With Myos, you can get between €10,000-2.500,000 without requiring ownership stakes or personal guarantees in return.

Accessing extra working capital provides you with the flexibility to allocate funds for a range of purposes, including:

📌 Boosting inventory levels

📌 Funding marketing campaigns

📌 Cover transportation costs

📌 Expanding your team

📌 Undertaking essential renovations, etc.

Don't miss out – sign up today and discover how Myos can empower your business to reach unprecedented heights!

To create a cash flow forecast, you need to:

The time frame for cash flow forecasting depends on your goals. Short-term forecasts may cover weeks or months, while long-term forecasts can span years. Most businesses use both to manage immediate needs and long-term financial planning.

What Is Cash Flow Forecast & Why It’s Important for a Business?