Even the mightiest small businesses have their fair share of ups and downs.

Imagine this: you're cruising along, riding the wave of success, when suddenly, boom!

A seasonal sales slump hits you like a ton of bricks.

Your invoices get paid late, your precious equipment takes a spontaneous vacation, and you find yourself in a tight spot financially.

Sound familiar?

Inventory financing is your secret weapon, explicitly designed to tackle those pesky inventory needs that can make or break a business.

Curious to know more? Of course you are!

So, keep reading to learn more about the best small business inventory loans, how they work, the pros and cons, and the requirements to apply for them.

Let's start!

As traditional bank loans may not be accessible or practical for numerous small businesses, the rise of online and alternative lenders has provided a lifeline.

These lenders offer smaller, quicker inventory loans suitable even for the smallest businesses that have never dabbled in business financing.

But now, you may wonder: which inventory loans are the best fit for small businesses?

Keep reading to discover the leading lenders specializing in inventory loans for small businesses.

Myos is a specialized financial provider offering asset-based funding and working capital tailored to small ecommerce businesses.

With comprehensive funding solutions, Myos enables businesses to overcome the obstacles associated with inventory management and cash flow.

By accessing the necessary capital, you can concentrate on nurturing your business' growth, enhancing customer service, and seizing opportunities in the market.

Leveraging the power of artificial intelligence (AI), Myos evaluates the market value of your products and provides a loan that aligns with your business needs, empowering you to drive growth and expansion.

With financing between €10.000-2.500.000, you can expand your business by:

1. With inventory financing, you can conveniently finance future orders directly with your manufacturer. Myos manages the deposit and balance payments, simplifying your financial process.

2. Stock financing utilizes your current inventory as collateral to facilitate the expansion of your store.

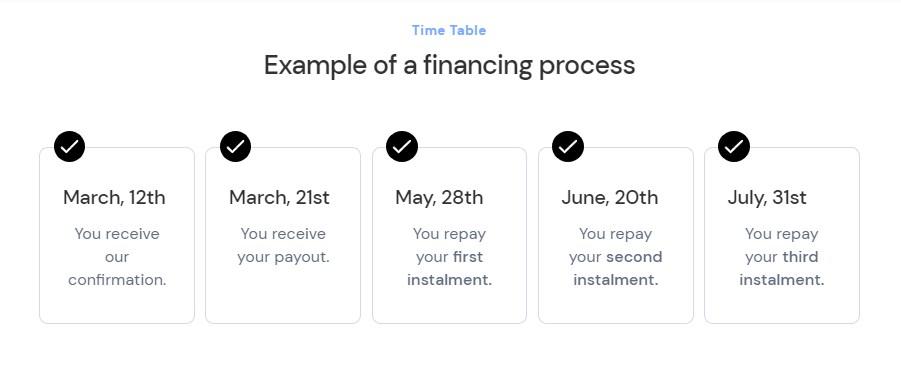

The repayment of the loan is flexible, allowing you to select a repayment term that suits your business needs, with repayment period lasting up to 24 months.

💡One of the significant advantages of Myos is that if you no longer need the funds, you can repay the loan early without any additional charges or fees.

This flexibility enables you to manage your finances efficiently and adapt to changing business circumstances.

It's worth noting that the monthly fee associated with the loan only applies to the outstanding capital, providing a fair and transparent fee structure.

The percentage fee is determined by your products' AI-calculated market value score, offering a tailored approach that aligns with the value and potential of your products.

✅ Myos only uses goods as collateral, eliminating the need for personal guarantees and reducing personal risk.

✅ More accessible qualifications open up opportunities for a broader range of sellers.

✅ The simple 3-step online application process minimizes paperwork and saves time, ensuring a smooth and efficient application experience.

✅ Quick funding with funds typically disbursed within 72 hours.

✅ Notifying suppliers or customers is unnecessary, ensuring confidentiality throughout the financing process.

✅ Flexible payment options at no extra cost allow businesses to choose the repayment structure that best suits their cash flow.

✅ Customer support is available via email, chat, or in-person, ensuring assistance whenever needed.

✅ Myos has partnered with over 200 warehouses in DACH and the UK and 70+ leading ecommerce service providers, offering additional resources and support.

❌ The funding amount may not be suitable for larger businesses with significant financing needs.

❌ Only available in certain regions.

To receive funding, you need to meet the following criteria:

Tide is primarily a business banking app designed to assist small to medium businesses in managing their time and finances effectively.

However, Tide goes beyond everyday banking services, providing its customers with various business loans and cash flow tools.

Tide's Cashflow Insights tool can assess your financial status using open banking, provide insights into how much you could borrow, and present you with the available options.

Tide Business Loans come in various forms, catering to different business needs.

Tide Start-up loans offer businesses loans with a flexible range of £500 to £100,000.

You can use this loan to purchase inventory or equipment, hire staff, or expand operations.

The loan term typically ranges from 12 to 60 months.

Interest rates and repayment terms are determined based on the business's specific circumstances.

To be eligible for a Tide Start-up loan, you must operate a business for 36 months or less and be a UK resident.

Additionally, each owner or partner in the business can apply for a personal loan of up to £25,000, with a maximum total limit of £100,000 per business.

Tide Business loans are a traditional financing option that requires a personal guarantee.

These loans, available through Tide partners, offer fixed and variable interest rates.

The loan application process is straightforward, and you can complete it within the Tide app.

Tide Business loans provide a wide funding range, starting from £500 and going up to £15,000,000.

The repayment terms vary from 1 month to 6 years, offering flexibility to align with your business needs.

Additionally, there is no specified minimum turnover or required time trading, making these loans accessible to businesses at different stages.

This loan option allows you to leverage your outstanding invoices to access immediate cash flow, helping you bridge the gap between invoicing and receiving payment.

The interest rates and repayment terms for invoice financing are tailored to each business's unique circumstances, ensuring a suitable arrangement for their financial needs.

Tide provides merchant cash advances, which offer a lump sum payment in exchange for a portion of future sales.

This option can be beneficial for businesses with fluctuating sales volumes.

💡 The interest rates for Tide business loans are determined based on several factors, including the loan type, borrowed amount, and the business's credit score.

Tide collaborates with various finance partners, including the British Business Bank, Iwoca, You Lend, Liberis, and Funding Circle.

Tide offers business loans through these lenders with interest rates typically ranging from 6% to 26.6% APR.

✅ According to the Tide website, the average time to get a business loan authorized is 3 minutes and 24 seconds.

✅ A flexible repayment plan ensures businesses can manage their repayments to suit their cash flow

✅ The transparency in their fee structure allows business owners to easily understand Tide’s cost of financing

✅ The opportunity to secure smaller loans without the need for collateral or undergoing stringent credit checks.

❌ Tide Business Loans may not be accessible to all businesses as they are available only to Tide customers.

❌ While Tide aims to offer competitive rates, they can vary depending on the business's creditworthiness.

%20(1)%20(1)%20(1).png)

LoanBuilder, offered by PayPal, is a fantastic choice for small business owners seeking short-term loans.

But you shouldn't mistake LoanBuilder for PayPal Working Capital, which operates similarly to a merchant cash advance.

In contrast, LoanBuilder functions more like a traditional term loan for businesses.

However, what sets LoanBuilder apart is its payment structure.

Unlike traditional term loans with monthly payments, LoanBuilder offers the convenience of automatic weekly payments for borrowers.

LoanBuilder offers business loans ranging from $5,000 to $500,000 with repayment terms between 13 and 52 weeks.

The application process is quick and straightforward - funding can be available as soon as the next day.

Rather than a traditional APR, LoanBuilder charges a flat borrowing fee, ranging from 2.9% to 18.72% of the loan amount.

LoanBuilder has no additional costs, such as origination fees or hidden charges.

The only time an extra fee applies is for late or returned payments, which incur a $20 charge.

It's important to note that, unlike PayPal Working Capital, you don't need to use PayPal to process payments to qualify for PayPal Business Loans.

✅ Short-term financing with terms of up to 52 weeks.

✅ Customized borrowing amounts and terms ensure that the loan aligns precisely with the cost and timeline of the intended investment.

❌ Weekly payments may not be suitable for businesses with cash flow patterns that benefit from a different repayment frequency.

❌The considerably high rates could put significant financial pressure on borrowers..

❌ Early repayment does not result in lower interest or fees compared to paying on schedule.

❌ Their list of prohibited industries is extensive, encompassing various sectors such as management and talent agencies, public administration, attorneys, religious organizations, gun stores, and more.

To be eligible for the loan, you must meet the following minimum qualifications:

%20(1)%20(1)%20(1).png)

Funding Circle functions as a lending platform, not a direct lender. They use institutional investors to meet loan requirements.

When you submit a business loan application, it is presented to the platform's institutional investors for consideration.

The platform serves as the middleman when you borrow money through Funding Circle.

Your loan will come directly from the investors, and any payments you make will return to the investors who funded your loan.

You can be confident that you won't need to communicate with the investors themselves.

Funding Circle provides unsecured fixed-rate small business loans ranging from £10,000 to £500,000.

The loan term can be as short as 6 months or extended to 6 years.

Upon taking out a loan, you will incur a one-time completion fee, which will be determined based on your risk rating and chosen term length.

The good news is that there are no charges for early repayment if you decide to pay off the loan in full before the end of your term.

In addition to small business loans, Funding Circle offers a couple of other business finance products:

1. FlexiPay

This option provides an interest-free line of credit with limits ranging from £2,000 to £250,000. With it, you can charge and repay an invoice over three months with a flat 4.5% fee per invoice.

2. Asset Finance

Funding Circle's asset finance allows you to use the asset you intend to purchase or your own as collateral for a loan. You receive up to £5 million, with a flexible term ranging from 1-7 years.

✅ A prior account with Funding Circle is not required to obtain a loan.

✅ The minimum loan term is just 6 months, allowing for quick repayment.

✅ There are no early repayment fees, providing flexibility to pay off the loan in full before the term ends.

❌ While collateral is unnecessary for a Funding Circle business loan, a personal guarantee is required.

❌ Funding Circle has limited customer service options, lacking access to branches or a dedicated app.

You must undergo credit checks to be eligible for Funding Circle's loans.

Your business should have a minimum trading history of one year and be based in the UK.

But the great news is that your business has no minimum turnover requirements to fulfill.

Selecting the best small business inventory loan is about more than finding the lowest rates.

There are other important factors to consider to choose the right option for your specific business needs:

If we could be biased, Myos ticks all the boxes above.

%20(1)%20(1)%20(1).png)

So, sign up today for a free, non-binding offer from Myos and let your business bloom!

16 Inventory Metrics for Better Analysis