Did you know that 82% of businesses stumble and fade away due to cash flow troubles?

That's like hitting a brick wall at full speed.

But did you know businesses that tame their cash flow chaos are a staggering 64% more likely to see their revenue soar?

Yes, you read that right—soaring!

This blog isn't about summoning financial wizards.

It's about giving you the keys to the cash flow kingdom.

We're diving deep into ecommerce cash flow – why it matters, how it shapes your growth, and, most importantly, how you can wield its power to your advantage.

Let's demystify the concept of cash flow and discover how it can be the key to transforming your aspirations into tangible results.

Let's begin!

Cash flow refers to the movement of money in and out of your business over a specific time frame, resembling an intricate dance of dollars.

When your inflows (money coming in) exceed your outflows (money going out), you're in the golden zone of positive cash flow.

This financial harmony lets you effortlessly pay your bills and cover essential expenses.

However, negative cash flow prevails if the outflows surpass your inflows, leading to a challenging financial situation.

Now, let's talk business.

Without cash flow, an ecommerce enterprise faces a grim fate – bankruptcy.

But positive cash flow isn't just about paying the bills, it's your ticket to:

So, how do you crack the ecommerce cash flow code? You can use eighter of these methods below:

1. The Direct Cash Flow Method lays out all cash inflows and outflows, from customer payments to supplier expenses.

Perfect for those following cash basis accounting.

%20(1).png)

2. Indirect Cash Flow Method: The trickier cousin adjusts net income for noncash transactions like depreciation or accruals.

And a little secret: the indirect method is the go-to for many ecommerce businesses due to accrual accounting practices.

Reading a cash flow statement may seem complex at first glance, but breaking it down into key components can help you understand your business's financial health and make informed decisions.

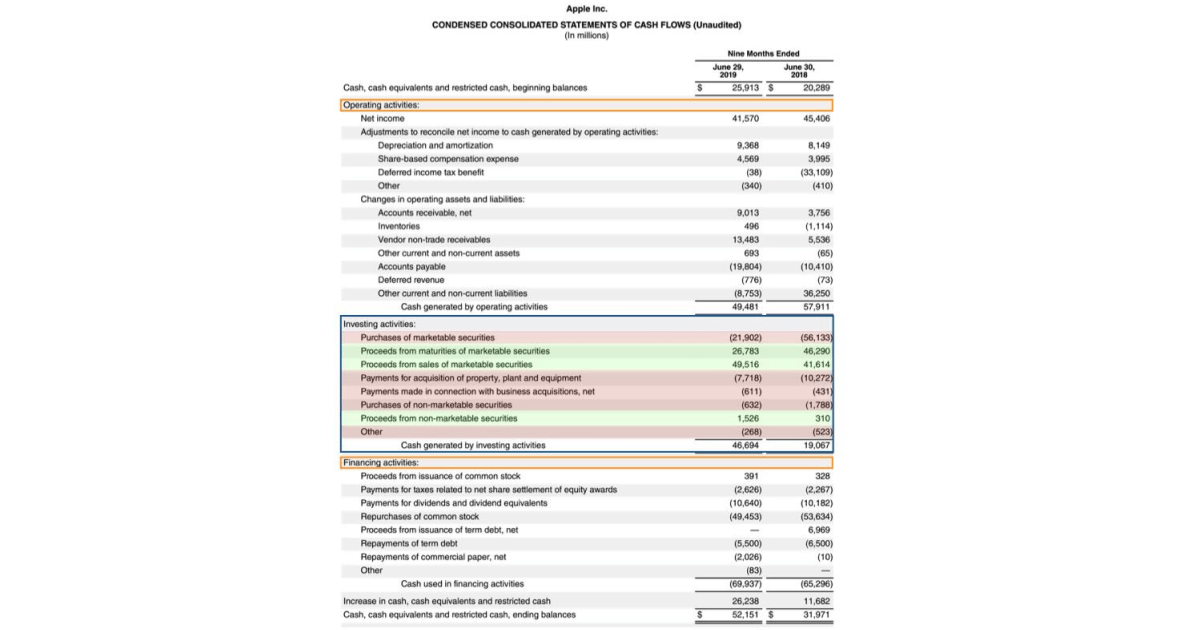

Step 1: Understand the Structure

A cash flow statement is typically divided into three main sections:

1. Operating Activities: This section details the cash flows from your core business operations, including cash received from customers and cash paid to suppliers, employees, and other operational expenses.

2. Investing Activities: Here, you'll find cash flows related to investments, such as the purchase or sale of assets, investments in other companies, and loans made to others.

3. Financing Activities: This section outlines cash flows from activities involving your company's capital structure, such as issuing or repurchasing stock, borrowing, or repaying loans.

Step 2: Analyze Operating Activities

Step 3: Explore Investing Activities

Step 4: Examine Financing Activities

%20(1)%20(1).png)

Step 5: Interpret the Overall Cash Flow

%20(1)%20(1).png)

Step 6: Consider Ratios and Trends

To gain deeper insights, consider calculating and comparing key cash flow ratios, such as the operating cash flow ratio, investing cash flow ratio, and financing cash flow ratio.

Step 7: Analyze Trends and Anomalies

Compare the cash flow statement with previous periods and industry benchmarks to identify trends, anomalies, or potential areas for improvement.

Look for consistent patterns in cash flows and investigate significant changes.

Cash flow isn't just another financial metric – it's your ecommerce superpower.

Understanding the key factors that impact your ecommerce cash flow is crucial to your business's financial health. Let's explore them in detail.

Your sales revenue serves as its lifeblood, and it's not just about increasing sales volume but also about maintaining a healthy revenue stream.

So here are a few steps on how to keep it that way:

Effective inventory management guarantees that the appropriate products are accessible when needed, preventing excessive stock that can waste valuable resources.

A successful pricing strategy must balance maximizing profits and staying competitive.

%20(1)%20(1).png)

Efficient credit and payment terms can significantly impact your ecommerce cash flow by affecting the timing of cash inflows and outflows.

Keeping track of and managing expenses is essential for maintaining a steady cash flow.

You can allocate resources towards growth and investment opportunities by eliminating unnecessary expenses.

Ecommerce businesses often encounter cash flow challenges arising from seasonal sales variations, marketing costs, inventory management, and delays in payment processing, affecting their financial stability.

To mitigate these issues, you can consider alternative financing options like Myos Stock Financing to ensure consistent liquidity and sustained growth.

Our process begins by assessing your existing inventory's value and determining the financing amount available.

While your inventory remains stored with your current provider, a portion will be utilized as collateral for the financing.

This injection of funds allows you to launch your new website and mobile app, implement targeted marketing campaigns, and ultimately amplify your online presence, attracting a broader audience and driving sales growth.

A positive cash flow is not just a financial metric; it's a critical driver of ecommerce success and growth.

Here's how maintaining a healthy cash flow can fuel your business growth, provide economic stability, and open doors to expansion:

✔️ Market Growth: The funds you generate can be channeled into entering new markets, expanding your customer base, and even exploring international growth opportunities.

✔ ️ Branding Power: You can launch impactful marketing campaigns that elevate brand awareness, attract a more extensive customer base, and establish your ecommerce business as an industry leader.

✔ Strategic Alliances: With surplus funds, you can consider acquisitions or partnerships that align with your growth objectives.

✔ Resilience: The business landscape is rife with uncertainties, from economic downturns to unforeseen disruptions. Positive cash flow is a financial cushion, offering stability during these challenging times.

✔ Reduced Dependence: Relying heavily on external financing, loans, or debts can burden your business with high-interest payments and financial constraints. Positive ecommerce cash flow reduces this dependence, allowing you more financial freedom.

✔ Supplier Advantage: With a healthy cash flow position, you can negotiate better terms, such as extended payment periods or discounts for early payments.

✔ Product Expansion: Positive cash flow provides the financial backing for product development, production, marketing, and distribution.

✔ Physical Presence: Leasing or purchasing retail spaces, stocking inventory, and establishing a physical storefront become feasible with surplus funds.

✔ Tech Enhancements: Positive cash flow empowers you to invest in advanced ecommerce technology, such as website enhancements, mobile apps, and personalized shopping experiences.

Flashy websites or trending products don't solely determine ecommerce success – it rests on the solid foundation of effective cash flow management.

As we conclude this comprehensive guide, it's clear that mastering ecommerce cash flow is a fundamental pillar for sustaining operations, managing expenses, and seizing growth opportunities, ensuring the stability and expansion of the business.

At Myos, we empower your business in three key ways:

✔️ Unveiling Hidden Value: Your assets hold true power. Our AI-based algorithm objectively values your inventory, securing financing from €10,000-2,500,000 based on tangible worth, not just credit standing. Access growth, regardless of credit history.

✔️ Energizing Cash Flow: Supercharge your ecommerce cycle with precise injections of funds. Bridge the gap between expenses and revenue, propelling your business with renewed financial vigor.

✔️ Paving Pathways for Growth: Myos fuels your expansion dreams, from team support to supplier relationships. Short-term funding, long-term impact – the boost you've been waiting for.

%20(1)%20(1).png)

Secure your business's future today!

Sign up and get a free, non-binding offer!

Cash flow in ecommerce refers to the movement of money into and out of your online business. It includes incoming cash from sales, investments, and financing activities and outgoing cash for expenses, inventory, and debt payments.

Cash flow is vital for your ecommerce business as it ensures you have the funds to cover expenses, invest in growth, and handle unexpected challenges. Positive cash flow helps maintain operations, support expansion, and enhance financial stability.

Cash flow represents actual cash movements, while profits reflect the difference between revenue and expenses. A business can be profitable but experience cash flow issues if customers delay payments or if there are large upfront expenses.

Ecommerce businesses can consider short-term financing options like lines of credit, business loans, or invoice factoring to bridge cash flow gaps and support growth initiatives.

11 Ecommerce Cash Flow Management Tips

Asset-Based Lending vs Cash Flow Lending - Which to Choose

Asset-Based Financing vs Revenue-Based Financing - Which To Choose