Are you considering acquiring a business and need the right funding?

Several business acquisition loans are available, each with its requirements and terms. Before applying for a loan, it is important to understand your business's fiscal situation and its assets and liabilities.

Acquiring a business can be a great way to grow and expand your company, but it can also be expensive.

What's more, obtaining a loan to purchase a business may be challenging if you have bad credit or no experience as a small business owner.

So, how is a business acquisition loan your right choice?

This article will explore the advantages and disadvantages of different business acquisition loans and provide tips to help you decide.

To learn more about how these loans can help you reach your business goals – keep reading!

A business acquisition loan serves as a catch-all phrase for various loans, including asset, term, and mezzanine financing.

It can be used for everything from purchasing a company's assets to buying out the current owner or taking over an existing lease.

Let's look at the key features of business acquisition loans:

Because these acquisitions often cannot be funded by the business's regular cash flow, companies use loans to avoid borrowing additional funds.

For example, your business can use an acquisition loan to make significant strategic acquisitions using a downpayment and repay the remaining balance over time.

Due to the high level of risk involved in business acquisitions, lenders frequently demand security.

Although they may change based on your situation and the loan, interest rates are often relatively high.

Banks, credit unions, the SBA, and internet lenders offer business purchase loans.

Their availability differs from country to country, so in this article, we'll focus on business acquisition loans available for small business owners in Europe.

Getting a franchise or buying out an established business may be done directly with the help of business acquisition loans.

These loans may be used for various purposes, including buying out existing owners, setting up an office, and purchasing equipment. They can also be used as working capital until you get things going.

Let's look at the benefits and drawbacks of business acquisition loans before you decide whether to apply for one.

Here are a few benefits of taking acquisition loans:

Like any loan, using a business acquisition loan to buy a new business might have certain disadvantages:

Now that you have seen some advantages and drawbacks of these loans let's see what types of business acquisition loans are on the market, starting with a few most common ones:

Asset-based financing enables you to utilize the assets of the business you're taking over as collateral for the loan. Up to 70–90% of the new company's asset worth may be advanced by the lender (assets include outstanding customer invoices, stock, equipment, and property).

Secured term loan—also known as senior debt since it is given precedence over other unsecured debt (lenders would receive money before other lenders if your business became insolvent). Rates can be set or adjustable, and lenders frequently provide an interest-only payment term.

Working capital or cash flow loans are made based on your company's anticipated future cash flow. If you cannot repay the loan, mezzanine debt might be converted into equity. Interest-only loans are frequently available from lenders, but the interest rate may be excessive because they carry a significant risk.

Private debt is a business acquisition financing provided by a personal business instead of a bank. If you cannot get funding elsewhere, private debt financing may be accepted for your company. Private debt, though, might be a pricey choice.

There are also some other available business acquisition loans, such as:

Remember that each type of loan comes with different requirements, the application process, and the time it takes to get the money you need.

Regarding business acquisition loans, the application might be trickier to complete than other forms of business financing.

It is because lenders must determine the viability of the business you are purchasing, evaluate the worth of any assets or property, and consider the performance of your current business.

Lenders or financial providers will review your personal and corporate credit history when applying for a business acquisition loan.

You could be required to sign a personal guarantee as part of the application procedure for some lenders.

They will also want details on both your prospective acquisition and your current business, including the following:

As mentioned above, there are several ways to get a loan, whether through a bank, credit union, government funds, the SBA, or various financial providers.

However, only some businesses are eligible for a loan since credit score and financial history comprise this decision.

It's also important to consider how quickly you need the money.

If you are in a hurry and don't want to miss a chance to acquire a business, then asset-based financing from Myos is the right choice.

Myos is an asset-based financial provider that supports sellers all over the world in accelerating their growth.

We provide working capital loans ranging from €10k to €2,5M with a monthly cost of 1% to 3% of the total amount borrowed.

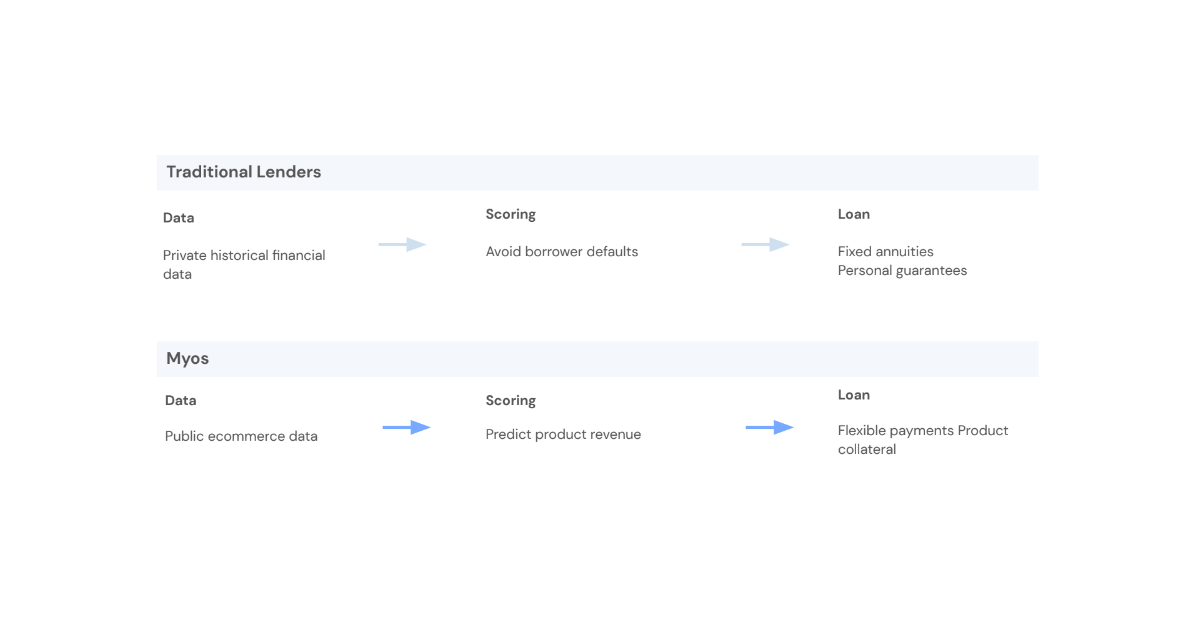

In contrast to conventional lending methods, Myos uses artificial intelligence to analyze the market position of merchants' online goods using information from platforms such as Amazon or Google Shopping.

We accept the sellers' inventory or incoming orders as collateral instead of personal guarantees.

Since there are no personal guarantees or credit checks and the flexibility of the payback schedule over 24 months, this speeds up the procedure for the seller.

And lastly, you don't need to provide a business plan, financial analysis, or annual accounts to get funded with Myos.

How to know if you're eligible for a business acquisition loan?

We prioritize the following points:

Grow your business faster and take advantage of opportunities that come your way with business acquisition loans.

These loans give you the financial support you need to make your dreams a reality.

Start your journey to success today. Explore our ecommerce loan options and find one that suits your needs.

A business acquisition loan is intended for the purchase of another business. It may be applied to lower acquisition costs, such as:

The lender's qualifying requirements will determine how much you are eligible to borrow. Before making a decision, they will consider the worth of the company you are purchasing, the value of your assets, their criteria for affordability, and your financial records.

Myos only takes the products as collateral. No fixed costs, no personal risks, and flexible repayment at any time. Myos provides working capital loans ranging from €10k to €2,5M with a monthly cost of 1% to 3% of the total amount borrowed.

Taking out a loan can be a great way to get the funds you need to cover an unexpected expense or make a large purchase. However, it is crucial to understand the advantages and disadvantages of taking out a loan before making this decision. It is essential to consider the terms of the loan, the interest rate, and any other fees associated with taking out the loan to determine if it is worth it for your particular situation.