Every business can face cash flow problems, especially during times of high spending or when revenue takes a dip. The trick is to find a solution that injects the money you need when you need it most.

If you have inventory sitting in your warehouse, waiting to be sold, you might have an untapped source of funding that could take your business to the next level.

Having the right resources at the right time can make all the difference!

Stock financing can be that resource, unlocking the potential within your inventory and helping your business grow.

Stay tuned to find out:

Let’s begin!

Stock financing, or inventory financing, involves unlocking the value tied up in unsold inventory to access working capital.

This form of financing is precious for businesses that experience fluctuations in sales, seasonal variations, or require capital to fund growth and expansion.

When you face periods of sluggish sales or payment delays and require immediate access to liquid capital, this is a great way to use your inventory as collateral to secure a cash loan.

Myos Stock Finance offers a streamlined and efficient way for businesses to secure growth capital using their existing inventory.

Unlike traditional lenders that rely heavily on credit history, Myos employs AI to assess the popularity of your products in various marketplaces, making the process more inclusive.

The beauty of this financing solution lies in its simplicity – no extensive paperwork or forms; the application process is swift and hassle-free.

Moreover, Myos requires only portions of your inventory as collateral, eliminating the need for personal guarantees, which is a significant advantage.

To secure the loan, you can use inventory, encompassing all the products or materials that have yet to be sold.

For example:

Lenders typically assess your inventory, and if it meets their criteria, you can often receive swift approval for a loan based on your comprehensive inventory records.

We place great importance on the following key criteria:

📌 Ecommerce Sales History: Your products must have a proven sales record in ecommerce channels ( such as Amazon, eBay, or your online store) for at least 50 days. This requirement indicates the market's demand and the potential success of your products.

📌 Shelf Life and Life Cycle: Your products should have a shelf life and life cycle of at least 1 year. This way, your products have a reasonable time frame for sales, reducing the risk of obsolete inventory.

📌 Minimum Price: The products you intend to finance should have a minimum selling price of at least €5. This criterion ensures that the funded products have a certain value in the market.

📌 Product Readiness: Your products should be ready for sale, meaning they are fully prepared and available for purchase by customers.

📌 Exclusions: We exclude specific product categories from our financing options. These include weapons, ammunition, branded watches, and COVID-19 products such as masks and rapid tests.

💡 Adhering to these requirements is essential for a successful financing application, as they reflect our commitment to supporting businesses with viable, market-ready products while maintaining ethical standards by excluding specific categories.

The process of stock financing typically unfolds in the following steps:

1. Inventory Valuation

Before entering a stock financing agreement, the lender assesses the value of the business's inventory. This valuation is crucial in determining the maximum amount of financing that can be extended.

2. Financing Agreement

Once the inventory's value is established, the lender and the business agree on the terms of the financing arrangement, like loan amount, interest rate, repayment schedule, and any applicable fees.

3. Release of Funds

The lender disburses the approved amount to the business after finalizing the agreement. You can use this cash infusion for various purposes, such as restocking inventory, covering operational expenses, or investing in growth initiatives.

4. Ongoing Monitoring

In many cases, the lender continues to monitor the inventory value regularly, and the financing arrangement may be subject to periodic revaluation. This way, the loan remains in line with the value of the inventory.

5. Repayment

As with any loan, you must make regular repayments, including principal and interest, as specified in the agreement. These payments are typically tied to the business's cash flow and may be structured monthly or quarterly.

The process to secure your business loan is remarkably simple and convenient.

It comprises three easy steps:

1. Inquire

In this stage, you can apply in as little as 5 minutes without requiring extensive documentation or private data. Myos conducts an AI product check based on publicly available data, so you can quickly get an offer within 24 hours

2. Receive

Once approved, you receive your growth capital after production, dispatch, or upon goods' arrival, allowing you to start selling a partial amount of your inventory immediately.

3. Settle

Myos offers a unique repayment system that aligns with your revenue.

After successful sales, you can settle part of the financing, and Myos releases further inventory accordingly. This process continues until your funding is settled and all products are released.

Fees and costs

Regarding financial terms, Myos offers fair and transparent conditions.

You only pay for what you use, with no minimum term and no fixed fees that penalize you for early repayment.

Your monthly fee on the outstanding capital depends on your product scoring.

If you choose to repay earlier, you'll pay less.

Myos's flexibility empowers you to tailor your financing to your business's specific needs, ensuring you can maximize your growth without unnecessary financial burdens.

It's a financing solution designed with your success in mind, offering simplicity, transparency, and financial freedom.

Stock finance offers several benefits:

✅ Boosts cash flow: It unlocks capital tied up in your inventory, providing funds for growth or covering expenses.

✅ Confidential: It's a private form of external finance, so you don't have to disclose it to customers or stakeholders.

✅ Supports your operating cycle: Enhances cash flow, enabling smooth operations and meeting demand.

✅ Provides capital during off-peak periods: Crucial for businesses facing seasonal fluctuations.

✅ Compatible with international trade: Suitable for importers and exporters.

✅ Accepts various types of stock: As long as your goods aren't in excluded sectors.

✅ Supports stock management: Requires regular updates to the lender, improving supply management.

Despite its advantages, stock finance may not be suitable for everyone:

❌ Costly: Depending on a lender, it can involve expenses such as initial valuations and ongoing valuation updates, making it more expensive than some alternatives.

❌ Limited accessibility: Some lenders require substantial inventory and extensive financial documentation.

❌ Risk of stock seizure: If you default on repayments, the lender may seize your stock.

❌ Complex for growing businesses: Adjusting financing to changing inventory levels can be challenging as your business expands.

Stock financing is suitable for businesses primarily acquiring and selling physical goods.

It is popular among businesses like ecommerce, brick-and-mortar retailers, and wholesalers.

Still, it is less beneficial for service-based businesses.

You may find stock financing to be the right choice for your business if:

We emphasize specific criteria when considering financing applications:

Meeting these criteria is essential for a successful financing application, as they reflect our commitment to working with established and genuine businesses in the specified regions.

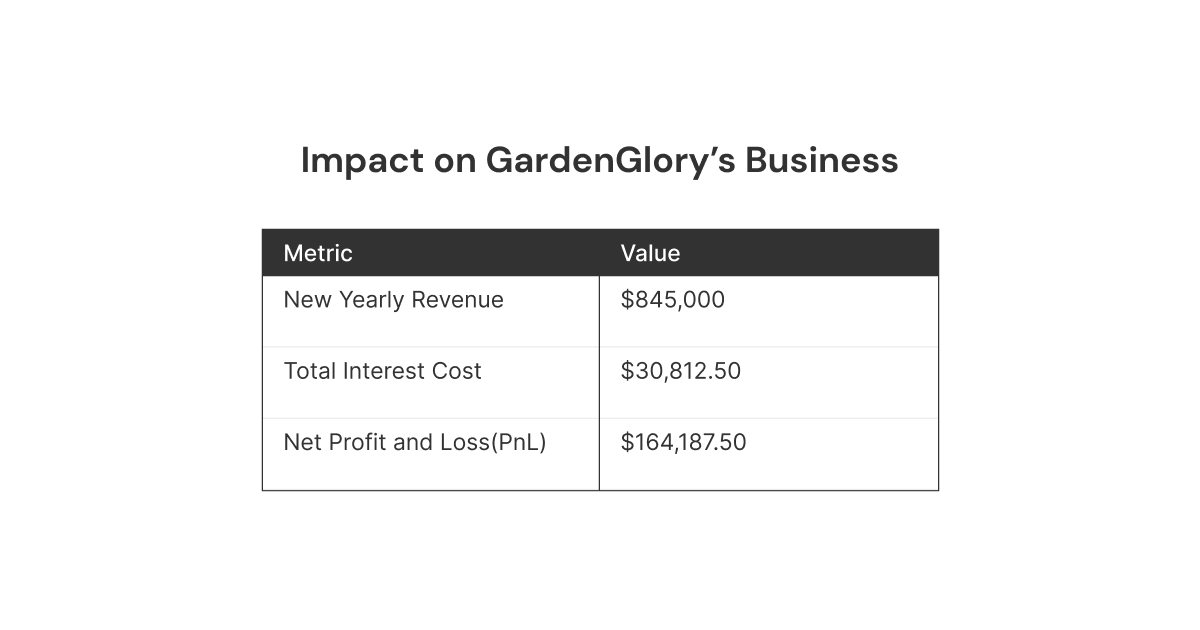

GardenGlory is a thriving gardening supply store that caters to a growing customer base.

As the demand for their products surged, they recognized the need for additional working capital to expand their inventory and improve their store infrastructure.

GardenGlory planned to use the funds to purchase a wider variety of gardening supplies, including seasonal items and specialty products, to meet customer demands effectively.

The influx of working capital allowed GardenGlory to expand its product range, enhance its store layout, and invest in marketing activities.

Their efforts paid off as their sales increased significantly, contributing to the growth and success of their business.

Stock financing, the financial wizard behind the scenes, transforms inventory into a dynamic business asset. In a world where adaptability is crucial, this financial tool offers companies the necessary flexibility.

It bridges the gap between inventory management and cash flow, enabling businesses to navigate seasonal ups and downs and pursue strategic growth.

What Makes Myos The Trusted Partner For Your Business?

Myos has different financing solutions that are designed for ecommerce needs.

Whether you sell on Amazon or eBay or have your online store, you can quickly secure between €10.000-2.500.000 simply using your existing inventory.

Benefits of Myos asset-based financing:

✔️ Fast process: Apply in 5 minutes and get funding in 3 easy steps.

✔️ Stay flexible: Enjoy a repayment term for up to 12 months.

✔️ No personal guarantees: We take only the product you sell as security.

✔️ No fixed costs: Pay only for what you need, no early repayment penalty.

✔️ 100% customer-friendly: Your personal Account Manager is always there for you.

✔️ Use our network: 200+ warehouses and 70+ partners in the Myos ecosystem.

Are you interested to learn more?

Sign up today and get a free, non-binding offer!

What is Growth Equity - A Comprehensive Guide

Black Friday Supply Chain and Inventory Planning for 2023

What is Merchant Cash Advance & Is It Right For Your Business?