Invoice financing is like a cash boost when your business needs it most.

If you are a small business owner who is often frustrated with waiting for customer payments, then, you will find it particularly helpful.

This article is your guide to understanding invoice financing.

We'll break it down into simple terms, explain how it works, compare it to invoice factoring, explore its different types and what it might cost you, and review the pros and cons.

We'll also help you figure out if invoice financing is the right move for your business.

Let's dive in!

Invoice financing, also known as accounts receivable or invoice factoring, is a financial arrangement allowing businesses to access a portion of the funds tied up in their unpaid invoices before the customer pays.

Essentially, it's a way to turn your outstanding invoices into immediate cash.

It's particularly valuable for small businesses in the ecommerce sector, which often deal with extended payment terms and cash flow constraints.

Here's how it works:

1. Generate an Invoice: First, you issue an invoice to your customer for the products or services they've purchased. The invoice specifies payment terms, including the due date.

2. Apply for Financing: You approach an invoice financing provider, such as a bank, online platform, or factoring company, with your unpaid invoice.

3. Approval and Advance: The financing provider reviews your application and assesses the creditworthiness of your customer. Once approved, they advance you a percentage of the invoice's value, typically 70-90%. As a result, you receive immediate cash.

4. Customer Payment: Your customer pays the invoice on the agreed-upon due date. The payment is made directly to the financing provider in most cases.

5. Rebate or Fee Deduction: After your customer pays the invoice, the financing provider deducts their fees and any interest charges. The remaining balance is then returned to you. This process may vary depending on the specific terms of your agreement.

6. Ongoing Process: You can continue to use invoice financing as needed, depending on your cash flow requirements and customer invoicing.

Ecommerce businesses can significantly benefit from invoice financing for several reasons:

✔️ It provides a predictable source of working capital, allowing ecommerce businesses to manage their day-to-day expenses and invest in growth without being held back by late-paying customers.

✔️ With immediate access to funds tied up in unpaid invoices, you can seize growth opportunities, such as expanding product lines, marketing campaigns, or increasing inventory.

✔️ It allows you to pay suppliers on time, which can lead to securing favorable terms.

✔️ Invoice financing decisions are primarily based on your customer's creditworthiness, not your business's credit history.

✔️ You can choose which invoices to finance, giving you control over the amount of capital you access and when. This flexibility is valuable for managing cash flow during seasonal fluctuations or unexpected expenses.

There are two primary types of invoice financing:

In this arrangement, the financing provider purchases your unpaid invoices and takes over collecting payments from your customers.

The provider typically advances you 70-90% of the invoice value upfront and then pays you the remaining balance, minus their fees, once the customer pays.

Let's say you sell office supplies to other businesses.

You have an outstanding invoice worth $10,000 with a payment term of 30 days.

You approach an invoice factoring company that offers an advance rate of 80% and charges a fee of 3% per invoice.

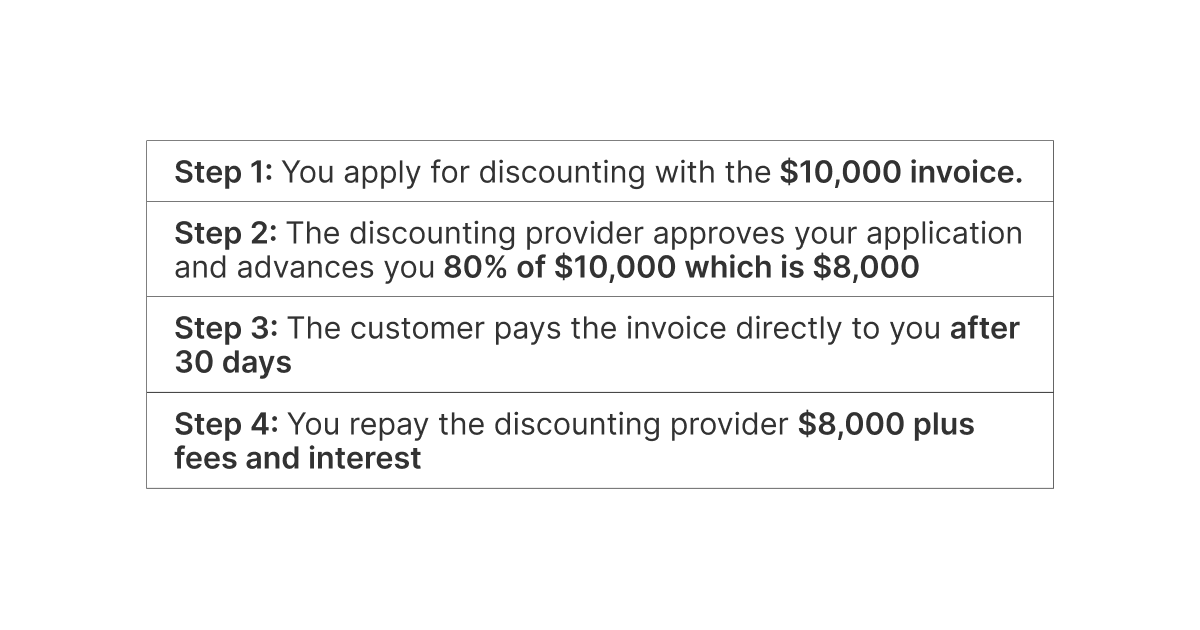

With invoice discounting, you retain control of collecting customer payments.

The financing provider advances you a percentage of the invoice value, but the customer continues to pay you directly.

Once the customer pays, you repay the financing provider the advanced amount plus fees and interest.

Using the same example, let's consider invoice discounting:

Invoice financing offers several advantages for small ecommerce businesses:

One of the most significant benefits of invoice financing is its impact on cash flow.

Instead of waiting for customers to pay, you receive immediate funds to cover operational expenses and grow your business.

Invoice financing provides access to working capital without taking on additional debt or giving up equity.

This flexibility allows you to invest in your business without borrowing from traditional lenders or relying on personal savings.

Invoice financing is unsecured, meaning you don't need to provide collateral like real estate or assets.

Your unpaid invoices serve as the collateral, making it accessible to small businesses that might not have significant assets to secure other types of loan.

Getting approved for invoice financing is typically quick, using online application process.

With the peace of mind from a stable cash flow, you can focus on growing your ecommerce business and attract more customers.

While invoice financing offers valuable benefits, it's essential to understand the costs and fees associated with this type of financing.

These costs can vary depending on the financing provider and the specific terms of your agreement:

Selecting the right invoice financing provider is not an easy task, so here are some factors to consider:

Understand the provider's fee structure, including discount or factoring fees, interest rates, and additional charges. Compare these costs across different providers to find the most cost-effective solution for your business.

Different providers offer varying advance rates, typically 70% to 90%. The higher the advance rate, the more immediate cash you'll receive.

Providers assess the creditworthiness of their customers to determine their risk when advancing funds. Ensure the provider has transparent and efficient credit-check processes to minimize delays.

Consider the quality of customer service and transparency of the chosen financing provider. You want a partner that communicates clearly and promptly addresses your concerns.

Whatsmore, look for honest online reviews to instill confidence in your choice.

Check if the provider allows you to choose which invoices to finance, which provides flexibility in managing your cash flow.

Despite its advantages, there are some common misconceptions about invoice financing:

❗It's Only for Struggling Businesses

Invoice financing is not a last resort for failing businesses. It's a strategic tool for managing cash flow and seizing growth opportunities.

❗It's Like Taking on Debt

Invoice financing is not a loan. You're using your accounts receivable as collateral, which doesn't impact your balance sheet or credit utilization.

❗ Customers Will Be Upset

Most are accustomed to businesses using financing tools and understand that it's a standard practice. The financing process is often transparent to them and doesn't negatively impact your customer relationships.

❗It's Expensive

While invoice financing costs are associated, it can be more cost-effective than alternative financing options, especially if it helps you avoid late payment penalties or secure supplier discounts for early payments.

❗It's Only for B2B Businesses

While invoice financing is commonly associated with B2B transactions, some providers also offer solutions for B2C ecommerce businesses.

One of the unique aspects of invoice financing is that it relies heavily on the creditworthiness of your customers rather than your own business's credit history.

Here's how customer creditworthiness affects the process:

To make the most of invoice financing for your ecommerce business, consider the following tips:

✅ Ensure that your invoices are clear, include all necessary details, and are sent promptly to your customers.

✅ Work with your customers to establish payment terms that align with your financing agreement. Longer payment terms can lead to lower fees.

✅ Don't use invoice financing for every invoice. Reserve it when you need extra working capital, such as during peak seasons or when pursuing growth opportunities.

✅ Keep an eye on your customers' payment habits. If a customer is consistently late, consider alternative financing options or adjust your terms with that customer.

✅ Maintain strong relationships with your customers to ensure they continue to do business with you.

You can also use a combination of invoice financing and other financing methods, like asset-based financing, to optimize your capital structure.

If you have substantial inventory waiting to be sold, why not capitalize on it?

Depending on your needs, Myos offers different financing solutions:

💡 With purchase financing, you can secure funding for your upcoming orders from your manufacturer. We handle both the deposit and balance payments on your behalf.

💡 Stock financing leverages your current inventory as collateral to drive your store's growth.

Invoice financing is a valuable tool for small ecommerce businesses seeking to maintain stable cash flow, invest in growth, and manage their working capital effectively.

However, the most significant drawback of invoice financing is its cost.

Invoice financing providers charge fees and, in some cases, interest on the funds advanced to you.

These costs can add up and erode a significant portion of your revenue.

So, if you are looking for an alternative, look no further than Myos!

✨ Myos doesn't depend on credit history assessments.

Many online businesses may lack a lengthy sales history to establish their creditworthiness, so Myos takes a different route.

We analyze open data related to your store, such as the quantity and pricing of items sold, to project the future performance of your products.

Our financing decisions are based on this assessment.

✨ Myos doesn't necessitate personal guarantees such as homes or vehicles.

Instead, our loans are collateralized by your inventory.

We secure a portion of your existing or prospective inventory through an agreement with your warehouse, safeguarding your personal assets from being entangled with your business affairs.

%20(1)%20(1)%20(1)%20(1)%20(1).png)

💰 With a simple online application, you can receive between €10.000-2.500.000.

This capital fuels vital growth areas like product launches, marketing campaigns, and inventory expansion, driving customer acquisition, increasing sales, and elevating your online store.

💼 Myos' asset-based financing stands ready to provide the necessary working capital, all while ensuring a worry-free experience, free from cash shortages and cash flow interruptions.

Do you want to learn more?

Sign up and receive a free, non-binding offer today!

What Is Stock Financing - Everything You Need to Know