With eCommerce flourishing and online stores amassing over 2 billion shoppers in the past few years.

So, if you're selling on Amazon or on your own website, more than likely you’re enjoying the success of these sales.

However, in order to keep up with demand and continue to scale, there is one concept: sellers must pay close attention to your cash conversion cycle.

It is the core of any cash-related optimization.

In this article, we'll examine how mastering your cash cycle may help you decide whether it's best to expand into new markets, buy additional inventory, or invest in new goods.

We’ll cover the basics of CCC, provide some useful examples and give some helpful tips that can help you implement it in your ecommerce business strategy.

Let’s begin!

The cash conversion cycle is the amount of time business takes to turn cash held in inventory into cash received from merchandise sales.

This should ideally be negative (i.e., you get paid by customers before you spend for the inventory).

However, this is difficult to achieve on Amazon.

Nonetheless, the key to maximizing financing options is to reduce the amount of cash held in inventory.

As a result, you can now scale more quickly without letting the quantity of bound capital limit your expansion.

In today's fast-paced business environment, growth is the ultimate goal for every organization. Whether you're a small startup or a well-established enterprise, the ability to grow sustainably and efficiently is crucial for long-term success.

While numerous factors contribute to a company's growth, managing its cash flow effectively lies at the heart of financial success.

It is a key metric that provides valuable insights into a:

✅ Company's liquidity

✅ Operational efficiency

✅ Overall financial health

Mastering the CCC entails optimizing the time it takes to convert inventory and other resources into cash inflows, allowing organizations to generate revenue and fund further expansion.

By reducing the CCC, businesses can:

🎯 Accelerate their growth

🎯 Improve profitability

🎯 Gain a competitive edge in the market

There are three main parts that make up the Cash Conversion Cycle (CCC), each representing an important part of how the business operates.

Let's explore these components in detail:

The ICP measures the average time it takes for a company to convert its inventory into sales revenue.

The process begins with acquiring or creating inventory and concludes with selling those goods to customers.

To meet consumer demand without incurring unnecessary costs, it's important to maintain a balance in inventory levels.

This means avoiding both excessive stockpiling and shortages, as they can lead to issues like increased holding costs and obsolescence.

Proper inventory management is vital in avoiding these hazards.

The ARCP calculates how long a business usually takes to get payment from clients after a sale.

It covers the credit terms provided to clients and the efficiency of the business's credit and collection policies.

A shorter ARCP demonstrates efficient receivables management, providing timely cash inflows and lowering the chance of bad debts.

The APDP measures how quickly, on average, a business pays its suppliers after receiving an invoice.

In addition, it indicates the credit terms that the business bargains with its vendors and its capability to efficiently control cash outflows.

A business can maintain good relationships with suppliers while extending payment terms to enhance its working capital position and manage cash flow efficiently.

Now that we have all “the ingredients”, the formula for calculating the cash conversion cycle is as follows:

A lower CCC indicates that the business is quickly turning its assets into cash, increasing liquidity and supporting expansion opportunities.

To achieve this, businesses can discover areas for improvement and put measures in place to maximize their cash flow and speed up growth by evaluating and managing each component of the CCC.

We'll examine several methods and best practices to help you master each stage of the cash conversion cycle and shorten the CCC.

But first, let's understand the importance of CCC in various industries.

Given that different markets function using distinct characteristics and business models, the cash conversion cycle's (CCC) relevance changes from one market to the next.

Let's take a look at the CCC's impact on several markets:

Management of the CCC is vital in the retail and FMCG industries, where inventory turnover is fast, and profit margins are generally thin.

By decreasing the CCC, stores may lower the risk of obsolescence, maximize profits, and hold the least amount of stock possible.

The ability to transform sales into cash rapidly is crucial for maintaining a consistent cash flow and meeting consumer demands, which is why a shorter CCC is preferable.

A retail business's cash conversion cycle typically falls between 79 and 87 days.

The CCC is an essential tool for manufacturers to enhance their supply chain and output.

By lowering the ICP, producers can reduce the amount of time and money spent on stockpiling products, boost productivity, and better adapt to shifting consumer preferences.

Maintaining positive relationships with suppliers is essential to a successful business, and so is a steady cash flow to meet manufacturing costs, buy raw materials, and pay employees.

On average, a manufacturing company's cash conversion cycle takes 46 days, with a standard variation of 65 days.

Since physical stock is typically low to nonexistent in the service sector, the CCC must focus on managing accounts receivable and payable.

Consulting and information technology enterprises, like many others in the service sector, rely substantially on prompt client payments to sustain cash flow and finance ongoing operations.

Companies in the service industry can boost their liquidity and invest in expansion efforts by decreasing their ARCP and improving their APDP with their suppliers.

A service business typically has a cash conversion period between 30 and 60 days.

The CCC is essential for financial security in the building and infrastructure industries since projects typically last long.

Managing the CCC becomes crucial to pay for personnel, buy materials, and cover other project expenses.

By improving their CCC, construction companies can reduce their exposure to financial risk, keep their cash reserves at a healthy level, and continue expanding without interruption.

It's a common struggle for construction companies to improve their CCC — on average, 74 days or more.

Mastering the CCC is crucial for companies in the technology and software sectors because their top priorities are new product development and fast time-to-market.

Shortening the ICP and collecting receivables quickly allows technology companies to reinvest in research and development, extend market reach, and capitalize on emerging possibilities in light of rapid product development cycles and changing customer needs.

Currently, there is no available data on the average CCC of businesses in the technology and software industries.

Regardless of the industry, a shorter cash conversion cycle offers several benefits:

It improves cash flow

✔️ Reduces the need for external financing

✔️ Provides financial stability

✔️ Enhances the ability to invest in growth initiatives

✔️ Businesses can unlock their full potential

✔️ Achieve sustainable growth

✔️ Stay competitive in their respective markets

Now, let's discuss effective strategies and best practices to help you succeed in the CCC and promote growth across different sectors.

Improving cash conversion is crucial for any business looking to shorten its cash conversion cycle and boost growth.

Here are some proven techniques to achieve this:

1. Efficient inventory management — To decrease the amount of money invested in inventory, consider using just-in-time inventory management techniques.

Look at past sales data and customer demand patterns to find the optimal inventory levels and prevent shortages.

2. Negotiate favorable payment terms — One way to improve your cash position is by negotiating extended payment terms with your suppliers while still maintaining good relationships with them.

This strategy enables you to keep your cash for a longer period before paying your bills.

3. Streamline accounts receivable processes — To ensure timely customer payments, it's essential to have efficient and effective accounts receivable processes.

This involves promptly sending out invoices, following up on overdue payments, and offering incentives for early payment, such as discounts or rewards.

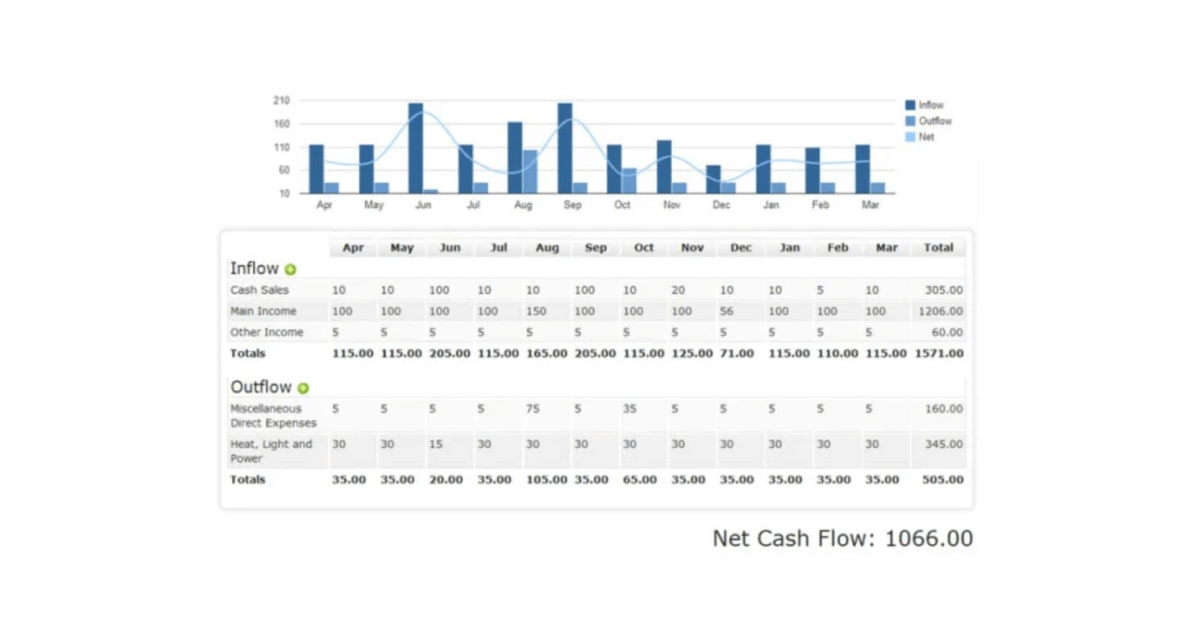

4. Implement cash flow forecasting — By creating a strong cash flow forecasting system, you can better understand where the money is coming in and going out.

This will help you predict any potential shortages or surpluses, which will, in turn, allow for more effective planning and decision-making.

5. Tighten credit policies — To minimize the risk of bad debt and late payments, assessing and strengthening credit policies is recommended.

You can achieve this by conducting comprehensive credit evaluations for new customers and setting credit limits to decrease the possibility of non-payment.

6. Optimize pricing strategies — To optimize profitability and competitiveness, assessing your pricing structure is important.

One way is to implement tiered pricing, subscription models, or other tactics that provide a steady revenue stream.

This will help maintain a consistent and predictable cash flow.

7. Leverage technology — By using financial management software and automation tools, you can simplify your financial processes, reduce the possibility of errors, increase efficiency, and access real-time information about your cash flow.

8. Accelerate cash receipts — Offer incentives for early payment, such as discounts or favorable terms, to encourage customers to pay invoices sooner.

In addition, explore options like electronic payments and online invoicing to expedite the collection process.

9. Manage working capital effectively — Focus on optimizing your working capital components, including accounts payable, accounts receivable, and inventory.

By efficiently managing these areas, you can release funds that can be utilized for fostering growth ventures.

10. Explore alternative financing options — To address temporary gaps in cash flow, you may want to explore options like invoice factoring, supply chain financing, or business lines of credit.

These alternatives can offer swift access to cash and help you manage your finances effectively.

For instance, Myos company is an excellent option for asset-based funding.

The most effective techniques for your business may differ based on factors such as your industry, size, and individual situation.

Therefore, to maintain ongoing success, it's crucial to regularly evaluate and modify your cash conversion strategies.

Everything we've discussed up until this point, obviously, works best when illustrated with an example.

Here we'll walk you through a few different Cash Conversion Cycle scenarios.

Let's pretend that you just dropped $160,000 on the stock today.

In 30 days, the goods will show up at the warehouse.

By day 45, all stock had been sold.

After a 14-day settlement process, Amazon will pay you on day 60.

Now that you've sold off your stuff, your $160,000 investment is worth $200,000. (net sales minus FBA fees, Amazon commission, and advertising costs).

Now is the opportune moment to invest in new stocks and initiate the cycle again.

By following this process, you can anticipate generating sales of $1.2 million on a yearly basis, resulting in six cash cycles per year.

Let’s assume you were able to optimize your cash flow through financing options such as revenue-based financing or merchant cash advance, to bring the conversion cycle down to 45 days.

At this point you’d be able to fit 8 (instead of 6) conversion cycles into the year.

Let’s assume you keep costs and revenues flat at the same pace: With the added two cycles you’d be increasing your sales by 33% from $1.2M to $1.6M, profit would increase from $240,000 to $320,000.

We can also look at the growth scenario:

The brand starts on the same level as in the previous scenario by managing a consistent 25% growth each month.

In that case the added 2 cash cycles translate into $1.7M of additional sales, $790,000 of additional profit - overall an 80% increase compared to the 6-cycle year.

A healthy cash conversion cycle can be a pivotal growth lever for your business.

By maintaining enough cash flow to fund new projects, while keeping your operations afloat, can save you money and time.

With enough cash to cover new ground faster than your competitors, you’ll become a leader in your niche in no time.

Businesses that want to boost their cash flow and growth should prioritize optimizing their cash conversion cycle.

They can reduce the time it takes to turn their investments into cash by applying the above mentioned tried-and-true methods.

Also, asset-based funding can significantly shorten the cash conversion cycle by using a company's accounts receivable, inventory, or equipment as collateral to secure financing.

This funding option allows companies to convert their assets into cash more quickly.

Here's how asset-based funding can help with the cash conversion cycle:

1. Improved liquidity — Provides immediate access to cash by leveraging assets that would otherwise be tied up.

2. Increased working capital — By leveraging assets such as accounts receivable, businesses can access cash upfront instead of waiting for customers to make payments.

3. Flexibility in funding — Offers more flexibility compared to traditional financing options.

4. Rapid cash conversion — It helps businesses to quickly convert their accounts receivable or inventory into cash.

5. Scalability and growth potential — It can support business expansion and growth initiatives.

Also, if you are interested in asset-based financing options, we advise you to break ground with the Myos company.

✅ Businesses registered in Germany, Austria, Cyprus, or the United Kingdom (UK).

✅ Businesses that have been operational for at least six months.

✅ Businesses with a minimum of 50 days of product sales history.

👍 Loans available ranging from £100,000 to £2,500,000.

👍 Monthly interest rates based on the borrowed amount.

👍 We provide funding for businesses as young as two months old.

👍 No minimum monthly turnover requirement.

👍 Funding period limited to a maximum of 24 months.

👍 Simple online application process with funding received within 72 hours.

👍 No personal guarantees or hidden fees.

👍 Free funding eligibility assessment.

Get a non-binding offer from Myos today to find out your options and kickstart the growth of your ecommerce business.

Working Capital: What It Is and Why It Matters to Ecommerce Businesses?