According to a survey, a staggering 82% of small businesses fail due to cash flow problems.

So, it's time to take action if you struggle to cover expenses or make it through the month or year.

When it comes to managing the financial health of your business, understanding the concept of the cash conversion cycle (CCC) is crucial.

When you genuinely understand this process, you can gain valuable insights into your cash flow, thus making more informed budgeting decisions.

In this article, we will explore how the cash conversion cycle can benefit your business and decipher the implications of a negative CCC.

The cash conversion cycle (CCC), or net operating cycle or cash cycle, is a metric that quantifies the duration, measured in days, for a company to convert its investments in inventory and other resources into cash flows from sales.

Its purpose is to assess how long each dollar invested in the production and sales processes remains tied up before you can convert it into cash.

While the result reflects the duration of converting assets into profits, it also signifies the efficiency of business operations.

When you purchase inventory, you don’t immediately get a cash payment.

Instead, purchases are often made on credit, allowing the company time to market the inventory to customers.

During this period, you make sales but still don't receive cash in return.

As a result, there is a delay in paying for the purchased inventory.

The process of buying inventory, managing accounts receivable, and receiving payments are interconnected.

So, it creates a cycle that shows how quickly investments are turned into cash through sales.

For example, if the payment due date for a purchase is June 1st and you receive cash from customers on June 15th, the cash cycle, in this case, would be 14 days between the payment date and the cash receipt date.

A shorter cash conversion cycle is advantageous for a business as it allows for quick inventory purchases, sales, and cash collection from customers.

The CCC encompasses three key periods:

A decreasing or stable trend in CCC values over multiple periods indicates positive performance, while rising values warrant further investigation and analysis, considering other influencing factors.

It's important to note that the applicability of CCC is limited to specific sectors that heavily rely on inventory management and related operations.

To calculate the cash conversion cycle (CCC), you need to consider three components: inventory days, accounts receivable days, and accounts payable days.

Here's the formula for calculating CCC:

Now, let's break down each component and illustrate the calculation process.

DIO refers to the average number of days it takes you to sell inventory.

Example: Suppose a company's average inventory is $100,000, and its cost of goods sold is $500,000.

DIO = ($100,000 / $500,000) * 365 = 73 days

DSO represents the average number of days it takes for a company to collect payments from its customers.

Example: If a company's accounts receivable are $50,000, and its total credit sales amount to $200,000, the calculation would be as follows:

DSO = ($50,000 / $200,000) * 365 = 91.25 days

DPO refers to the average number of days a company takes to pay its suppliers for inventory or other goods and services.

Example: Suppose a company's accounts payable is $30,000, and its cost of goods sold is $400,000.

DPO = ($30,000 / $400,000) * 365 = 27.375 days

Now, let's put it all together to calculate the cash conversion cycle (CCC):

CCC = DIO + DSO - DPO

= 73 + 91.25 - 27.375

= 136.875 days

In this example, the cash conversion cycle is approximately 136.875 days, which indicates working capital insufficiency.

The purpose of the CCC formula is to evaluate the effectiveness of working capital management.

Similar to other cash flow calculations, a shorter cash conversion cycle indicates that the company is proficient in selling inventory and converting those sales into cash while handling supplier payments.

It is crucial to compare the cash conversion cycle with other companies operating in the same industry and analyze it over time.

This analysis provides insights into whether the company's cash conversion cycle is considered "normal" by its industry peers.

The cash conversion cycle calculation relies on multiple variables.

Calculating any of these variables inaccurately could affect the entire analysis and potentially influence your decision-making process.

As a result, it is crucial to exercise caution when calculating the variables involved, such as Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO), to ensure accuracy and avoid any errors in the final calculation.

Several strategies can help reduce the cash conversion cycle:

Now, let's explore a few examples of a negative cash conversion cycle in action:

Platforms like eBay and Amazon frequently exhibit a negative cash conversion cycle.

This is because third-party sellers utilize these platforms to sell their goods and receive buyer payments.

However, the platform may hold the payment for a specified period before disbursing it to the seller.

During this time, the platform maintains a negative cash conversion cycle by retaining cash from buyers while the seller awaits payment.

Consider the scenario of running a vintage clothing boutique.

Suppose you purchase some 90s dresses from a supplier and sell them through your website.

However, you only need to pay the original supplier after you've made the sale and received payment from the customer.

It creates a negative cash conversion cycle as you convert your investment in inventory into cash from the sale before needing to settle the payment with the supplier.

In both examples, the negative cash conversion cycle benefits businesses because of the time lag between selling their products and paying their suppliers.

In addition, it provides a temporary cash-flow advantage, enabling the company to utilize the funds from sales before incurring expenses.

Most businesses strive to achieve a low or negative CCC because it signifies that the company can generate more cash from its sales than it spends on inventory purchases and bill payments.

However, ecommerce businesses typically have high CCCs as they cannot rely on supplier credit to finance their operations.

Instead, they tend to reinvest the funds from their operations into purchasing additional inventory or expanding their business to stimulate further sales growth.

Since Myos is created for ecommerce sellers specifically, with the following financing options, you can do just that:

1. Purchase financing allows you to place orders from your manufacturer as usual. At the same time, we take care of your deposit or balance payment. Accelerate your growth and remain flexible with additional working capital.

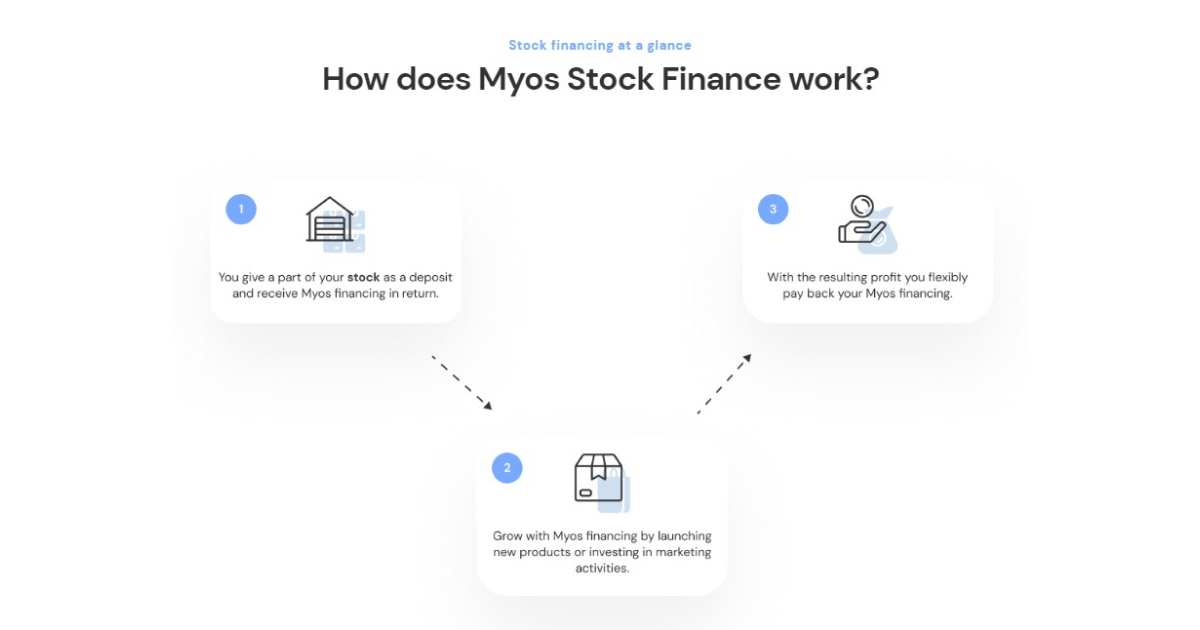

2. Stock financing lets you use your current inventory to get new growth capital quickly for any purpose you see fit, from new inventory to marketing campaigns.

💡 At Myos, we understand sellers' unique needs, so our approach involves using your products as collateral without extensive paperwork or personal guarantees.

With us, you can say goodbye to fixed costs and personal risks, as our flexible repayment structure allows you to settle the funding at your convenience.

Unlike traditional financing options, there are no penalties for early repayment or hefty lump sum payments.

Instead, you only pay a monthly fee based on the outstanding capital, with your product scoring determining the precise percentage.

By repaying earlier, you gain financial freedom and enjoy the benefit of reduced fees, ensuring a more favorable and rewarding financial boost for your ecommerce business.

A negative cash conversion cycle (CCC) holds significant advantages for a business:

Implementing best practices for managing a negative cash conversion cycle (NCCC) is crucial to maintain optimal cash flow:

1. Regularly assess the financial strength of your suppliers to ensure they can meet their payment obligations. Consider diversifying your supplier base to minimize the impact of any one supplier's financial challenges.

2. Establish efficient invoicing procedures and streamline accounts receivable management. Follow up on late payments and negotiate payment plans with customers who cannot pay in full upfront.

3. Review your customer credit policies to ensure they are appropriate and align with your business goals. Consider offering incentives such as early payment discounts to encourage prompt invoice settlement.

4. Optimize inventory turnover by implementing effective inventory management processes. Utilize demand forecasting systems to align inventory levels with customer demand better and minimize excess stock.

Different tools can help you streamline processes, improve efficiency, and provide valuable insights for better decision-making. For example:

1. Enterprise resource planning (ERP) systems integrate various business functions, including finance, inventory, sales, and purchasing.

2. Customer relationship management (CRM) software manages customer relationships, sales pipelines, and order processing.

3. Inventory management systems enable you to optimize inventory levels, reduce carrying costs, and improve inventory turnover. With real-time data on stock levels, reorder points, and lead times, you can align inventory with customer demand and reduce cash tied up in excess stock.

4. Advanced financial analytics and reporting tools provide in-depth insights into cash flow, working capital, and CCC performance.

By visualizing data and benchmarking against industry standards, you can develop strategies to optimize your CCC.

5. You can expedite cash inflows and streamline the payment process by leveraging electronic payment solutions, such as online payment gateways or digital wallets.

6. Cash flow forecasting tools can help you analyze historical data, sales forecasts, and anticipated expenses to predict cash flow gaps, plan for working capital needs, and take proactive measures to manage your CCC effectively.

It's important to note that the suitability of specific tools and technologies depends on your business's size, industry, and particular needs.

Nevertheless, implementing the right combination of tools can significantly enhance cash conversion cycle management and improve financial performance.

In today's fiercely competitive marketplace, where companies vie for market share and customer loyalty, mastering the cash conversion cycle is the key to thriving.

It means managing your money and resources wisely to make more cash, work more efficiently, and stand out in a competitive marketplace.

By closely monitoring your finances, using new tools, and making solid plans, you can ensure your money flows smoothly, and your business stays strong.

And if you want to ignite your financial potential, Myos offers numerous benefits.

%20(1)%20(1)%20(1).png)

Get between €10.000 and 2.500.000 with our asset-based financing for the following sellers:

So, sign up with Myos today and start fueling your success!

5 Best Amazon Inventory Management Software To Consider in 2023