Imagine this: You're a small business owner with big ambitions.

You need funding to make those ambitions a reality, but the thought of giving up a chunk of your company doesn't sit well.

Well, guess what?

There's a financial avenue that lets you have your cake and eat it, too.

It's called non-dilutive funding, and it's like getting a cash infusion without sacrificing your business's ownership.

In this blog post, we're breaking down the ins and outs of non-dilutive funding for small businesses, showing you how to fund your growth without losing your shirt.

Non-dilutive funding refers to various financial resources and methods businesses, particularly startups, can use to secure capital without surrendering ownership shares or equity in exchange.

However, obtaining bank loans can prove challenging, particularly for fledgling enterprises.

At the same time, options such as grants and tax incentives are inaccessible for numerous businesses.

A growing number of private lending firms and fintech enterprises have emerged to address this issue, offering avenues to access non-dilutive funding solutions, mainly through asset and revenue-based financing.

Dilutive financing, or equity financing, is precisely as the name suggests – it involves obtaining funds in exchange for a share of your business.

If you give up some of the ownership of your company, you will inevitably lose some control and a portion of your potential profits.

In other words, when a company undergoes dilutive financing, the ownership percentages of the existing shareholders decrease as the ownership is spread among a larger number of shareholders.

Dilutive financing is common when companies seek external investment, such as venture capital or angel investment, and are willing to exchange ownership for the capital required to fund their operations, growth, or new projects.

There are various forms that non-dilutive funding can take. Let's explore these options in the following sections.

Loans represent a straightforward variant of non-dilutive financing.

Emerging businesses can secure the necessary funds for marketing initiatives or operational costs through this type of capital without dilution. Loans incur interest and are obtainable from banks, private lenders, friends, family, and fintech companies.

There are also 2 of the most prominent representatives of this ''alternative financing'':

This financing type uses your business's physical assets, such as equipment, inventory, or accounts receivable, as collateral to secure loans. This approach allows you to access funds without giving up ownership. Still, it carries the risk of asset forfeiture if you don't meet loan payments.

Another non-dilutive funding type is acquiring funds based on a percentage of your business's future revenue. This type of financing allows you to repay the loan over time without equity dilution.

Grants are monetary awards government agencies, organizations, or foundations provide to support specific projects, research, or initiatives.

They do not require repayment or equity exchange.

Governments offer subsidies and tax breaks to promote certain activities, like research and development or energy-efficient projects. These incentives provide financial support without dilution.

It involves licensing your company's intellectual property to other businesses in exchange for royalties. It allows you to generate revenue without giving up ownership.

Collaborating with larger companies can lead to non-dilutive funding through sponsorship, joint projects, or direct financial support.

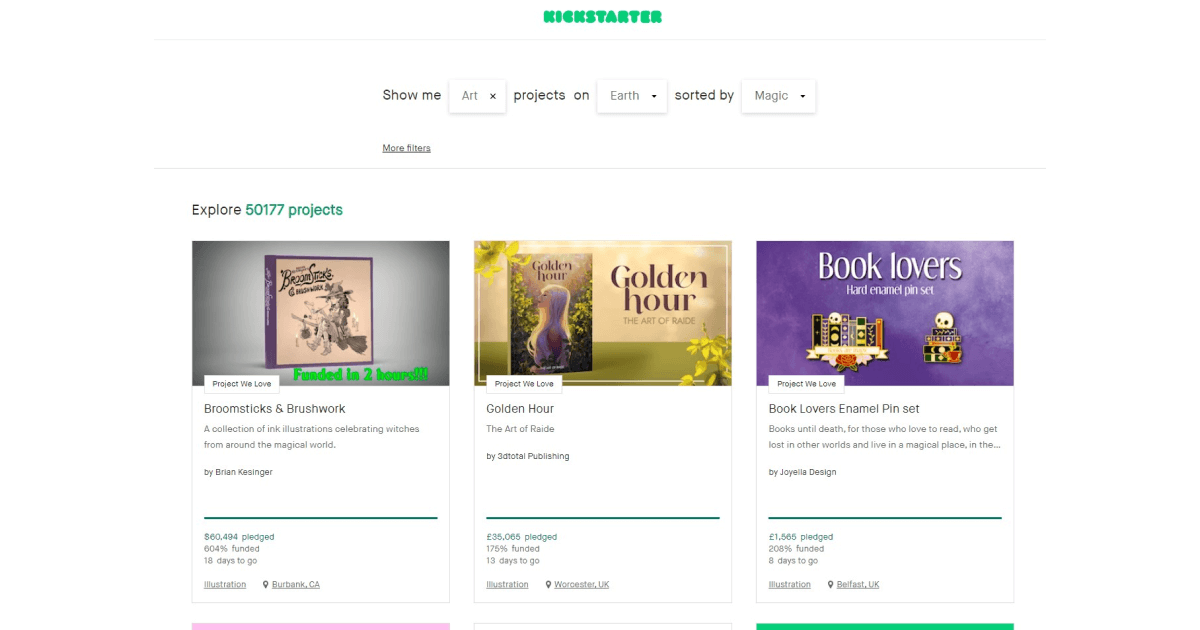

Crowdfunding platforms enable you to raise funds from many individuals, typically in exchange for early access or products. This approach doesn't involve equity dilution.

Organizations and institutions may provide grants for research projects, enabling you to pursue innovation without equity exchange.

Various government initiatives provide financial support for specific industries or activities, such as agriculture, clean energy, or technology development.

The main benefits of non-dilutive funding are quite evident.

You don't have to surrender any ownership stake in your company to obtain it, and it won't lessen the ownership percentage of your current shareholders.

As a result, this leads to increased retained earnings and dividends.

Moreover, debt financing offers tax advantages, including reduced tax liabilities through interest payments.

Here are other 9 significant advantages to consider:

1. You can use non-dilutive funds for any purpose, such as product development, marketing campaigns, or operational expenses. The flexibility of these funds enables you to allocate them strategically as needed.

2. Some sources of funding, such as grants, do not require repayment. It relieves the burden of having to repay debt, which is often a concern with loans and equity financing.

3. Depending only on equity financing can result in concentrated ownership among a small group of investors. Non-dilutive funding helps diversify your funding sources, which lowers the risk.

4. In the early stages, startups often need help to obtain equity funding. However, non-dilutive funding can provide vital assistance during this time, especially when traditional funding sources may be limited.

5. By participating in grant programs and partnerships, you can gain access to mentors, experts, and potential customers. Building these connections can pave the way for valuable collaborations.

6. If your business has valuable equipment or inventory, asset-based financing can be a helpful option for securing loans.

7. Non-dilutive funding often involves fewer regulatory complexities than equity funding, allowing for a smoother process.

8. With fewer equity stakeholders, decision-making processes can be faster and more agile, enabling your business to respond swiftly to opportunities.

9. Non-dilutive funding options are adaptable and can suit various business models and industries, allowing for creative funding solutions.

While non-dilutive funding offers several benefits, it's essential to consider its drawbacks:

When looking for non-dilutive funding sources, it is crucial to consider several factors.

These include evaluating the alignment of cash flow, the speed of funding, the required amount, and any regulatory obligations.

✔️ Cash flow: One option to consider is revenue-based financing, which adjusts repayments to match revenue and helps mitigate cash flow risks. Another option is asset-based financing, which allows for seasonal cash flow fluctuations and provides speedy access to capital without giving up equity.

✔️ Speed: Choose between lengthy processes like grants or swift options like alternative lending based on urgency.

✔️ Amount: Tailor choices to funding needs; venture debt for larger amounts and short-term loans for smaller sums.

✔️ Regulations: Understand and meet funding criteria to ensure successful financing.

When it comes to ecommerce, creating a successful online store goes beyond having high-quality products and an attractive website.

Do you want to avoid the hassle of presenting economic analyses, annual accounts, and business plans to financiers and banks?

With Myos, that's all in the past.

We prioritize your products. Apply for financing swiftly and seamlessly online, with minimal forms and paperwork.

By providing funding for important growth channels such as product launches, marketing campaigns, and inventory scaling, this financing avenue can help you reach new customers, boost sales, and improve your digital storefront.

Before submitting your request, you can choose between inventory and stock financing.

1. With purchase financing, you can easily finance your upcoming orders directly with your manufacturer. We take care of the deposit and balance payments on your behalf.

2. Stock financing leverages your current inventory as collateral to empower the expansion of your store. With added capital, you can channel resources into your chosen growth strategies, whether marketing initiatives or introducing new products.

Myos Financing - Key Advantages:

Experience worry-free growth with Myos financing. Ensure a steady cash flow to meet demands and exceed expectations confidently.

So, sign up and get a free, non-binding offer today!

Non-dilutive funding benefits startups, small businesses, and enterprises aiming to maintain control and ownership while accessing growth capital.

Grants are available for various business types, including technology startups, research and development projects, social enterprises, and those engaged in innovation.

Funding that doesn't involve giving up ownership can be used to enhance products, advertise, research, make operations more efficient, and improve infrastructure.

Depending on the funding source, credit history may have varying importance. Some options, like grants, prioritize project feasibility over credit history.

5 Best Alternative Business Funding Options for Small Businesses