Starting or expanding a small business often requires financial assistance, and securing a business loan is a common avenue for entrepreneurs to fuel their ambitions.

However, the traditional approach of obtaining a loan through collateral can be a major stumbling block for many small business owners.

If you also wonder that, then the chance is that you are seeking a small-business loan to help your company grow or overcome unexpected challenges.

But what if your business doesn't have assets to use as collateral?

Great news! There are financing options available that don't require collateral for approval.

So, read along and find the solution that best fits your business needs.

Let's start!

Instead of relying solely on the borrower's assets as security, lenders consider other factors to assess creditworthiness and determine the loan terms.

Here's how they typically work:

📍 Creditworthiness Evaluation

Lenders will closely examine the borrower's credit history, both personal and business-related. A strong credit score, good payment history, and a low debt-to-income ratio can increase your chances of securing a loan without collateral.

📍 Business Financials

Lenders will also review your business's financial statements, including income statements, balance sheets, and cash flow projections.

They assess factors such as revenue, profitability, and sustainability to evaluate the health of your business and its ability to repay the loan.

📍 Business Plan and Purpose

A well-prepared business plan that outlines your objectives, strategies, market analysis, and growth prospects can help demonstrate the soundness of your business and increase your chances of loan approval.

📍 Personal Guarantees

Lenders may ask for personal guarantees instead of collateral, putting personal assets at risk if the loan goes unpaid.

📍 Interest Rates and Loan Terms

Loans without collateral may have higher interest rates compared to loans with collateral, as they are considered riskier for lenders.

Loan terms, including repayment period and installment amounts, will vary depending on the lender, loan amount, and borrower's financial situation.

📍 Loan Amounts and Eligibility

It's important to note that business loans without collateral are typically available for smaller loan amounts than loans requiring collateral.

No-collateral business loans come in various forms, and the ideal option for your company depends on your funding requirements, the intended use of funds, the speed of funding, and eligibility criteria.

Here's an overview of common types of no-collateral business loans to consider:

When your business requires equipment but lacks collateral, unsecured business loans from online alternative lenders, peer-to-peer platforms, or crowdfunding options can provide a valuable solution.

With this financing option, the equipment you purchase is collateral, enabling faster funding and catering to startups, businesses with poor credit, or those needing swift equipment financing.

Unsecured equipment financing offers flexibility and accessibility for businesses in various stages of growth.

However, interest rates may be higher due to the perceived risk of unsecured loans, and additional fees, such as origination fees or administrative charges, may apply.

A business line of credit provides a renewable funding source that grants you access to funds up to a predetermined credit limit.

This versatile financing option is well-suited for startups, new businesses with limited credit history, and those needing flexible or emergency funding.

Unlike a traditional loan, where you receive a lump sum upfront, a line of credit allows you to draw funds up to the predetermined limit as required.

It's important to note that interest rates for unsecured business lines of credit are typically higher than those for secured loans, as they pose a higher risk to lenders.

Additionally, various fees may apply, such as:

Before pursuing a business line of credit, carefully assess your business's funding needs, repayment capabilities, and projected cash flow.

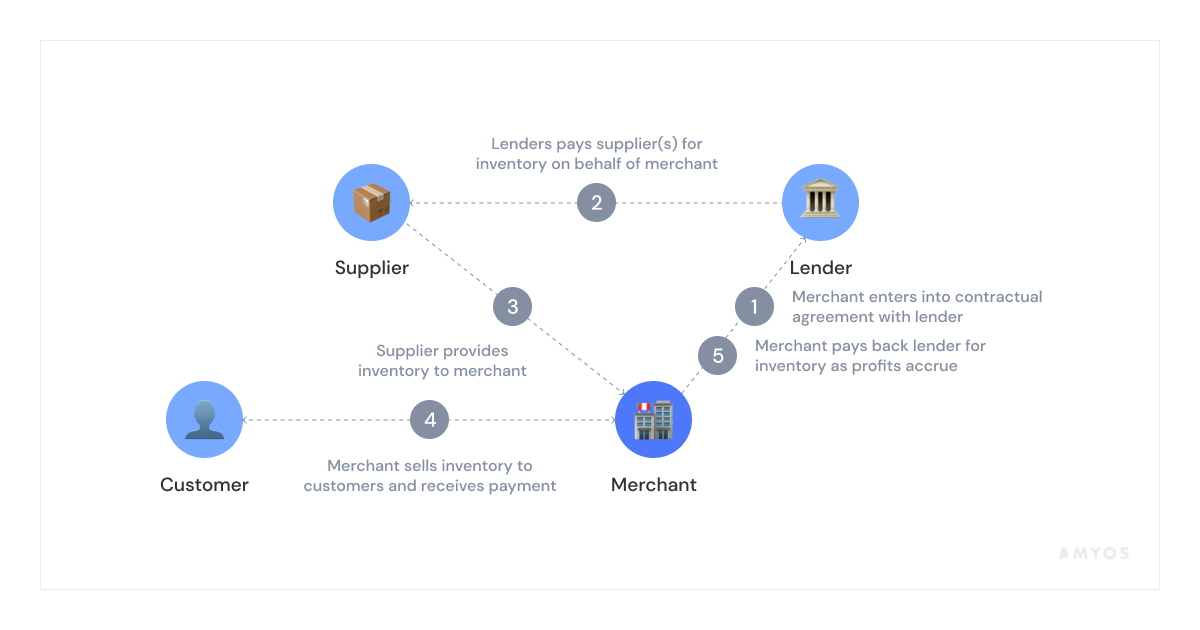

Short-term inventory financing offers a valuable funding solution to purchase manufacturing supplies or stock retail or wholesale establishments.

It allows you to secure the necessary inventory while using it as collateral, eliminating the need to pledge personal or business assets for security.

While short-term inventory financing offers benefits, such as fast access to capital and increased purchasing power, it's crucial to consider the associated costs.

Interest rates can be higher, especially for borrowers with less favorable credit profiles or limited business history.

So, to secure the most favorable terms, you should:

As a result, it will help build lender confidence and potentially leads to more competitive interest rates.

Many online businesses may lack a long sales history to demonstrate their creditworthiness.

As such, we don't rely on traditional credit history checks.

Instead, we utilize open data about your store, such as sales volume and pricing information, to predict the future performance of your products.

Based on this scoring, we determine the amount of financing we can provide for your store.

Secondly, we provide funding without requiring personal guarantees tied to your personal assets like your house or car.

Instead, we secure a portion of your existing or future inventory through an agreement with your warehouse.

So, you can still obtain the necessary working capital by keeping your assets separate and protected.

Depending on your business needs, you can choose between the 2 financing options:

1. Inventory financing allows you to finance your future orders with your manufacturer, where we take care of the deposit and balance payments for you.

Case study

Imagine you own a stationery supplies shop, and the back-to-school season is approaching, signaling a significant increase in customer demand.

So, you need to place a bulk order with your suppliers to meet it.

However, financing the order upfront can strain your cash flow and limit your ability to cover other operational expenses.

With Myos, you place the order with your suppliers, and we take care of the payment on your behalf.

The inventory is then delivered to your store, ready to meet the demands of the upcoming season.

📌 As a result, you can focus on marketing, enhancing the customer experience, and maximizing sales opportunities during this crucial time for your stationery supplies shop.

2. Stock financing uses your existing inventory as collateral to fuel your store growth.

With extra capital, you can invest in any expansion strategy, such as marketing or new product launches.

Case Study

Consider the scenario where you sell sports and fitness products, such as yoga mats, gymnastic balls, and thera bands.

You have identified an opportunity to expand your product offering by launching dumbbells. However, to do so, you require additional funds.

First, Myos evaluates the value of your current inventory and determines the financing amount we can provide for those products based on the assessment.

Your yoga mats and gymnastic balls are still with your storage provider, and Myos has allocated a portion of them as collateral to assist you in obtaining the necessary financing.

📌 With the extra funds available, you can now concentrate on launching your dumbbells and investing in marketing activities to improve their visibility.

Invoice factoring, or accounts receivable financing, presents a valuable short-term funding solution.

Here's how it works: a portion of the invoice value is provided upfront by the lender, with the remaining balance disbursed once the lender receives payment from your customer.

This type of financing is particularly beneficial for businesses that experience long payment cycles or have customers with a history of delayed payments.

While it provides a valuable financing solution, the costs can be higher than traditional loans.

Factors such as discount fees and service fees can affect your overall profitability.

📌 Working with reputable lenders and conducting thorough research will help you find the most competitive terms.

Merchant Cash Advances (MCAs) offer a viable solution for businesses needing quick funding. MCAs provide a lump sum upfront based on projected future revenue.

Rather than a fixed interest rate, repayments are calculated using a factor rate, which represents a percentage of your company's sales on a daily or weekly basis.

Although MCAs can be advantageous for startups, seasonal businesses, or entrepreneurs who have poor credit or fluctuating revenue, it's important to acknowledge their possible drawbacks.

Due to their unique repayment structure, MCAs can result in high effective interest rates, especially when sales are booming.

Therefore, before considering an MCA, analyze your business's financial situation and assess whether the anticipated revenue can comfortably accommodate the repayment structure.

One alternative financing option that doesn't require collateral is revenue-based financing (RBF).

With RBF, eligibility is determined based on your business's profitability rather than collateral.

Unlike traditional loans, RBF operates on a unique payment structure.

Instead of fixed monthly installments, borrowers make frequent payments based on a percentage of their revenue.

This flexible arrangement aligns with the business's cash flow and can ease financial strain during slower periods.

While RBF offers an opportunity to access funding without collateral, it's crucial to maintain a sustainable revenue stream.

Depending solely on borrowed funds can result in an overwhelming repayment burden, especially if revenue fluctuates significantly.

The Small Business Administration (SBA) presents the SBA 7(a) loan program, typically requiring collateral for approval. However, collateral may not be necessary for $25,000 or less loans.

These loans often offer attractive features, such as lower interest rates and longer repayment terms, making them suitable for startups with modest funding requirements.

It's important to note that the lender has the ultimate discretion regarding collateral requirements.

Therefore, it's crucial to maintain a strong credit profile and present a compelling loan application to enhance the chances of approval without collateral.

Determining whether unsecured business loans are the right solution for your business involves weighing their pros and cons.

✅ No collateral is needed for unsecured business loans, so your assets are safe.

✅ Getting an unsecured loan can be simpler with online lenders or alternative options like crowdfunding and peer-to-peer lending, saving time and effort with a simplified application process.

✅ With no collateral appraisal or documentation required, unsecured loans typically offer faster funding.

❌ Lenders may request a personal guarantee, putting personal assets at risk if the loan defaults.

❌ Possible higher fees and interest rates, especially for businesses with lower credit scores.

❌ Unsecured loans have less favorable terms, including shorter repayment periods and smaller amounts.

Obtaining a small business loan without collateral requires careful planning and preparation:

1. Start by researching lenders who offer such loans and focus on building a solid credit profile.

2. Develop a comprehensive business plan and ensure your financial statements are accurate and up-to-date.

3. Explore different loan options.

4. Complete the loan application accurately and review the terms and conditions, including interest rates and repayment schedules.

5. Consider seeking guidance from financial advisors or loan specialists to navigate the process effectively.

Following these steps can increase your chances of securing a small business loan without collateral, empowering your business to grow and thrive.

And, with Myos, you can enjoy the following benefits:

If you’re curious to learn more, sign up today and get a free, non-binding offer!

Small Business Grants in UK - Everything You Need To Know