In today's world, well-managed finances are everything, particularly cash in economic turmoil.

So, fast access to cash is necessary these days.

However, there are several ways to handle a steady income infusion, including Supply Chain Financing and Factoring.

Their popularity demonstrates that the Total Turnover value in the Factoring Industry of the EU in 2022 was 2.4 million euros, up from 2 million euros in 2021.

This implies an increase of 20% in one calendar year.

To grasp the reasons behind the popularity of these financing methods, this article will explore both of them.

Let’s start!

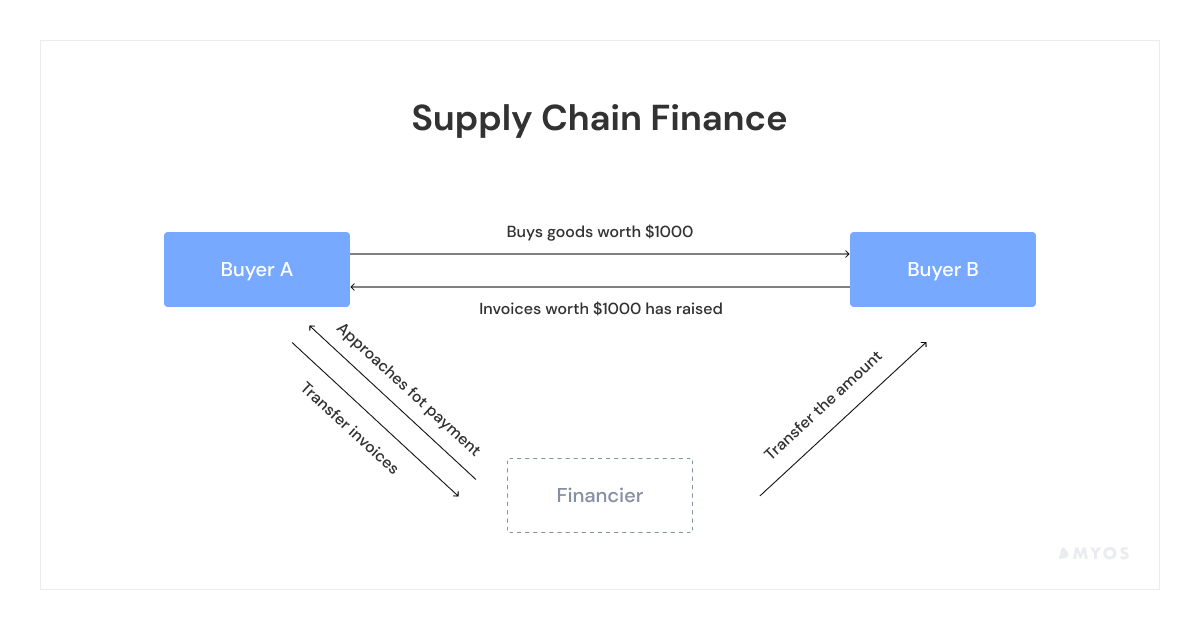

Supply Chain Finance is a business tool that reduces costs and improves business efficiency. It is a set of funding financial methods that optimize cash flow.

Between Buyer and Supplier exists a 3rd party or Financier to pay the Invoices earlier than stated as due date.

It is quite like Invoice Factoring, and yet there are differences.

Supply Chain Finance is not a loan or a debt. It is a useful tool for freeing up cash including the Financier.

Large institutions and corporations favor this approach for rapid cash influx, while small and medium-sized businesses also prefer Supply Chain Finance due to its speedy performance.

Another option for businesses is Factoring, which functions like a business loan.

With this type of financing, you give your unpaid invoices to a third party through Factoring.

This involves collecting money from clients through the mediation of a Factoring company, often known as a Factor (which charges for its services).

So, let’s briefly review what are the Factoring company's roles:

✅ notifies your customers about the transaction

✅ gives instruction about the payment method

✅ provides immediate access to cash after invoicing, without waiting 30-90 days

Additionally to the above listed, you can receive up to 70-90% of invoice value.

Factoring is a helpful instrument that is becoming increasingly popular as a global source of outside funding.

For instance, we are witnessing an increase of +18,3% in 2022, compared to 2021 Total volume in the Factoring industry.

Furthermore, in the EU, the Factoring industry represents 12,3% of Europe's GDP in 2022.

Because of the above-mentioned benefits, Factoring is good for corporations of all sizes.

Both of those above-mentioned financial methods manage Finances.

The main difference between Supply Chain Finance and Factoring is Assets.

In the Table below, there are more differences between Supply Chain Finance and Factoring.

Like any other business tool, Supply Chain Finance and Factoring have advantages and disadvantages.

So let’s check them out!

In Supply Chain Finance there is a faster and easier path for working capital.

Large Supplying Companies prefer this kind of business cooperation with Buyers, due to receiving cash in advance, for a small fee.

And yet, Small and medium-sized Companies like this, because of the inexpensive kind of short-term credit. Plus, the risk of debt is minimal.

✅ Fast & secure way for collecting cash.

✅ Invoices are paid promptly, avoiding debt or penalties.

✅ Offers greater flexibility to the company.

✅ Can improve the supplier's balance sheet.

🔴 Typically, a fee is charged by the third party.

🔴 The third party may require control over all receivables, reducing flexibility.

🔴 Companies may have limited control over the entire process.

Likewise, Factoring also obtains pros as well as the Supply Chain Finance tool.

Factoring with upfront payment improves a good Balance Sheet.

This leads us to the fact that a strong Balance Sheet provides every company with more flexibility.

✅ Allows the supplier to maintain control throughout the entire process.

✅ Suppliers can choose which invoices to include in the process.

✅ Effective in managing fluctuations in seasonal sales.

✅ Does not require collateral for financing.

✅ Provides fast access to capital for the supplier.

🔴 Associated with higher risk due to the above-mentioned factors.

🔴 Advance payment often incurs higher fees.

🔴 Certain factors may impose hidden costs, potentially reducing profit margins.

🔴 Suppliers bear the responsibility of assessing the customer's creditworthiness, which can be expensive.

These days, with business changing, it's very important to collect money.

Nonetheless, adaptability and flexibility are essential survival skills for everyone. To do those targets, Factoring and Supply Chain Financing proved to be a good choice.

However, when you opt between these two types of financing, businesses still need to deliberate about what will be useful for them.

And, as we can see above, both Supply Chain Finance, as well as Factoring have their drawbacks and advantages as well.

Selection between two of these methods depends on individual needs and preferences including risk related to each industry.

Myos offers customized answers for a range of financial challenges, increasing cash reserves, supporting company growth, and minimizing payment volatility.

With Myos, you can grow without stressing about cash flow issues or running out of money since we provide you with the operating capital you need.

Myos functions without individual assurances, freeing you up to concentrate on expanding your enterprise.

👍 There are no extra fees, and you have 12 months to pay back the finance. You can repay the money without facing any penalties, even if you decide after a week that you no longer need it.

👍 Myos does not operate as an intermediary for you, your vendors, and your clients. By doing this, you keep your connections with them and your competitive advantage intact.

👍 Financing applications are submitted online and don't need a lot of paperwork or long forms.

Amazon, eBay, and other B2C & D2C online sellers may get between €10.000 and €2.5m using Myos finance.

Check if your company meets these standards to find out:

✅ Your company is a legitimate business and is not a shell or shelf company; it has its registered office in Germany, Austria, Cyprus, or the United Kingdom (UK).

✅ It has been operational for at least 6 months.

✅ It has been selling products for at least 50 days.

✅ Your goods start selling from £5 (UK) or €5 (EU).

✅ Your goods are ready for retail.

Would you like more information on how Myos can change your company?

Sign up to get a complimentary, no-obligation offer and start growing your business starting today!