In the fast-paced business world, limited companies need a constant cash flow to fuel their growth.

But getting hold of that much-needed capital isn't always a walk in the park.

Some challenges and factors can make or break your chances of securing a business loan.

In this article, we're diving headfirst into the exciting world of limited company business loans.

We'll check out the different types of loans available and how they work.

Additionally, we will delve into the eligibility criteria in general and provide different types of limited company business loans to increase your chances of being approved.

So, join us on this journey to unlock the door to financial growth for your company!

In various countries, a limited company is a specific legal structure that ensures a clear separation between the business's legal identity and its owners or shareholders.

As a result, the company possesses its own distinct assets and liabilities, entirely separate from its owners.

Now, let's talk about the benefits of a limited company. It offers shareholders something called "restricted liability."

This means that shareholders are safeguarded and held responsible only for the amount of money they initially invested in the company.

So, in the unfortunate event that the company encounters financial difficulties or goes bankrupt, shareholders will not lose more than their initial investment.

Their personal assets remain protected, and they are not liable for the company's debts beyond their investment amount.

Operating a limited company requires having at least one director and shareholder. The shareholders elect these individuals to manage the company's affairs.

However, it's important to understand that the company is a separate legal entity from them.

In the UK, for instance, it is legally required to have both a director and a shareholder for a limited company.

To ensure compliance, registering the company with Companies House and regularly filing accounts are necessary steps.

Let's say you and a couple of friends decide to start a small company to sell handmade crafts online.

You register it as a limited company.

Each of you becomes a shareholder, and one is the director responsible for managing the day-to-day operations.

And, as a limited company, your business has its own rights and responsibilities under the law.

The company keeps its profits, but the director can only withdraw money for their salary or any loans they might have taken from the company.

Here’s one vital piece of advice to keep in mind when running a LTD business company:

💡 Keep personal finances separate from the company's to maintain transparency and compliance.

This practice will ensure the smooth operation of your business and protect it from any potential financial difficulties.

Business loans for limited companies are customized financial products designed to cater specifically to the needs of businesses that operate as limited companies, meeting their unique requirements and structures..

And as a separate legal entity from its owners or shareholders, it has its own legal identity and financial standing, making it eligible to apply for loans in its own name.

Banks, financial institutions, and alternative lenders offer these specialized business loans to limited companies.

The loans can be used for various purposes, such as:

✔️ Financing expansion plans

✔️ Managing cash flow fluctuations

✔️ Funding other business-related activities

Like any other loan, limited company business loans also have specific requirements that businesses must meet to be eligible to apply.

These criteria help lenders assess the creditworthiness and financial stability of the limited company, ensuring that the loan is a suitable and low-risk investment for the lender.

Lenders with specific criteria can make well-informed choices about which businesses to give loans to.

This ensures that they lend to businesses with a better chance of paying them back while safeguarding their interests.

Let's review the requirements for a limited company business loan.

Let's look at what applying for a limited business loan entails.

Limited companies need to conduct thorough research on their financing options.

By comparing offers from various lenders, businesses can find the option that best suits their requirements.

Once a suitable option is identified, it is important to carefully review and understand the loan's terms and conditions before entering into an agreement.

Seeking advice from financial advisors or experts is also crucial to ensure that the loan aligns with the company's financial objectives and ability to repay.

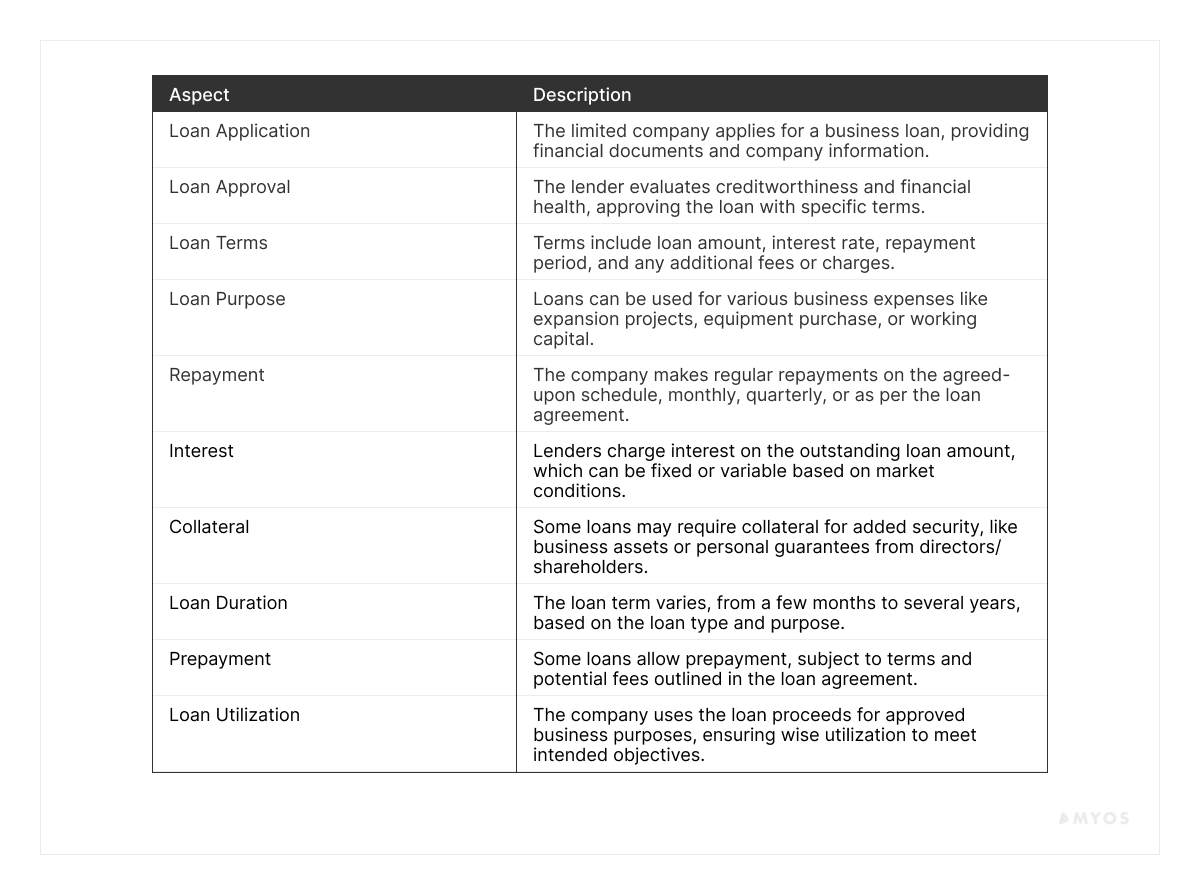

As a general guideline for the limited business loan application process, we have provided the following table.

Lastly, before we delve into the various types of limited company business loans, it's essential to acknowledge both the advantages and disadvantages associated with this financing option. Understanding these aspects will provide you with a clearer perspective on how this type of funding can benefit your business and its implications for the future.

✅ Business Growth — Limited company business loans provide the necessary capital to fuel business expansion, fund new projects, or invest in equipment and technology.

✅ Separate Legal Entity — As a limited company, the business's legal identity is distinct from its owners, which means the owners' personal assets are generally protected in case of business debts or bankruptcy.

✅ Lower Interest Rates — Loans for limited companies typically offer lower interest rates than other types of loans, as lenders consider the company's creditworthiness and financial stability.

✅ Flexible Repayment Terms — Many limited company loans offer flexible repayment schedules, allowing businesses to adjust their repayments according to their cash flow and business cycles.

🚫 Personal Guarantees — In some cases, lenders may require personal guarantees from the company directors or shareholders, making them personally liable for the loan if the business defaults.

🚫 Collateral Requirement — Depending on the loan type and amount, lenders may demand collateral, such as assets or property, to secure the loan, posing a risk of losing valuable assets if the business fails to repay.

🚫 Impact on Credit Score — Defaulting on limited company loans can negatively affect the company's credit score, making it challenging to secure future financing and potentially leading to higher interest rates on subsequent loans.

🚫 Limited Company Liability — While limited company structure offers liability protection for owners, there are still responsibilities and legal obligations to meet, including filing annual accounts and complying with regulatory requirements. Failure to do so may lead to penalties or potential legal issues.

An asset-based loan is a financing option where your limited company can secure funds using its assets as collateral.

These assets can include accounts receivable, inventory, equipment, or real estate.

The loan amount is determined based on the value of the assets pledged as security.

Asset-based loans benefit companies with valuable assets that might not qualify for traditional loans due to credit issues.

Furthermore, it allows businesses to unlock the value of their assets to fund operations or growth initiatives.

Myos is an asset-based company that offers customized solutions to empower sellers to achieve their business goals.

They provide loans ranging from £100,000 to £2,500,000, tailored to match specific borrowing needs, with AI-driven insights for valuable data analysis.

Myos also supports businesses as young as 2 months old and has no minimum monthly turnover requirement, making it accessible for companies of all sizes.

Here are some additional benefits of acquiring a limited business loan from Myos:

👍 No personal risk or guarantee is required.

👍 The funding period is limited to 24 months, allowing for strategic planning.

👍 The hassle-free online application process ensures quick funding within 72 hours.

Plus, with Myos, you won't face penalties for early repayment since there are no fixed or lump-sum payments.

Instead, you'll only pay a monthly fee based on the remaining capital.

Your product scoring determines the percentage fee, and if you choose to repay earlier, your total payment will be reduced accordingly.

This flexible approach allows you to manage your funding without worrying about additional costs if you settle it beforehand.

Want to find out more? Check our funding calculator for free.

A revenue-based limited company loan is a financing option where businesses repay the loan based on a percentage of their future revenues.

Instead of fixed monthly payments, the loan is tied to the company's performance, making it a more flexible option that adjusts to cash flow fluctuations.

This type of loan is especially beneficial for businesses with varying revenue streams, as it allows them to manage repayments more effectively and avoid excessive financial strain during lean periods.

A business line of credit is a flexible financing option that gives your limited company access to a predetermined credit limit.

It enables you to draw funds from the credit line whenever needed and only pay interest on the amount used.

It's an excellent option for managing short-term cash flow fluctuations or covering unexpected expenses.

A merchant cash advance is a form of financing where the lender advances you a lump sum, which you repay through a portion of your daily credit card sales or sales receipts.

This option is ideal for businesses with fluctuating revenues, as the repayment amount adjusts based on your daily sales.

Term loans are limited business loans with a fixed repayment period and interest rate.

They provide a lump sum of money upfront, which you pay back in regular installments over the loan term.

These loans are suitable for financing long-term projects or significant investments, such as equipment purchases or expansion plans.

However, getting term loans may be difficult as they heavily rely on credit scores.

Limited company business loans are a fantastic financing option designed specifically for businesses operating as limited companies.

They come with numerous benefits, like lower interest rates and flexible repayment terms, empowering businesses to grow without losing equity. Having a separate legal identity allows limited companies to access funds to expand operations, invest in new ventures, and strengthen financial stability.

Nevertheless, it's crucial for businesses to fully grasp the loan terms, eligibility criteria, and possible risks before borrowing.

By carefully assessing their financial needs and capabilities, businesses can make well-informed decisions and strategically utilize limited company business loans to achieve their long-term objectives.

Thus, these loans can be a great tool to support your business's future success.

Why not get started with tried and true solutions?

Myos is a well-known and reliable strategic growth partner offering flexible terms and conditions to support your business.

With their proven track record, you can confidently embark on your growth journey, knowing Myos has the expertise to empower and guide you.

To qualify for our funding, your company must fulfill the following requirements:

If you meet the eligibility criteria, don't hesitate to seize the opportunities.

Get our non-binding free offer and start growing your business without any delay!

Asset Conversion Cycle vs Cash Conversion Cycle

Short-Term Business Loans vs Long-Term Business Loans - Which is Better?