Do you own a business that needs funding?

Debt Financing and Equity Financing are two significant types of financing that your business can use to keep cash flow in good shape.

Debt Financing comprises acquiring a standard loan from a traditional lender, such as a bank.

In contrast, Equity Financing comprises acquiring funds by offering a stake in the company's ownership.

In this text, we will go over their key differences, as well as their benefits and drawbacks, so you can understand which one is best for you.

Let’s start!

Debt Financing is a way of getting necessary funds for your business by borrowing from a lender.

Subsequently, you repay the borrowed amount over a specified period, including associated fees and interest.

The interest rates may vary depending on the loan product and can be either fixed or variable.

Still, there are diverse forms of Debt Financing, including:

In addition, Debt Financing can be either secured, backed by an asset you own, or unsecured.

Secured debt, given its lower risk for the lender, is generally more accessible to obtain and comes with lower servicing costs.

Equity Financing is a method of raising capital for your business by selling shares of ownership, or equity, to investors.

In exchange for their investment, these investors become partial owners of the business and share in its profits and losses.

Unlike Debt Financing, there is no obligation to repay the invested capital, but investors gain a stake in the company's success.

Here are a few examples of common types of Equity Financing:

The primary distinction between debt and equity finance is ownership.

Debt Financing does not require any ownership of your company, while Equity Financing does, and equity investors become part-owners with voting rights that can affect the company’s decisions.

Equity investors may provide essential support in the form of financial and non-financial resources, professional advice, and access to their contact network in exchange for reducing your shareholding portion.

Debt Financing requires you to pledge an asset as collateral for the loan, such as real estate or equipment. In case you are unable to repay the loan, the financing company has the right to seize the asset to recover the funds.

On the other hand, Equity Financing risks are lower from investors' point of view, however, the cost of giving away equity includes giving up future capital appreciation and dividends, which may be endless.

In Debt Financing you usually repay in weekly or monthly installments, and you must repay both the loan amount and interest over a specified period.

Equity Financing does not require you to repay any amount. Instead, an Equity Financing company will take a share in the future earnings of your company.

Debt Financing is usually a faster and easier process, and you can obtain funds from the lender in a matter of weeks, or even days in some cases.

When applying for Debt Financing, you will typically be requested to submit collateral, which are physical assets such as property or machinery, as a security precaution for lenders.

After your application is granted, you must return the loan in accordance with the terms of your agreement with the lender.

If you need funding quickly, Equity Financing may not be the best option because it is a long procedure. And, finding an appropriate investor and negotiating terms, among other things, might take time.

Once you've worked out the terms and other legal issues with the investor, you can give up the agreed-upon percentage of ownership in your firm in exchange for funds.

Debt Financing does not require any engagement from the financing company because it relates to the practice of raising funds for your business from other sources, often in the form of loans.

A lender is not a shareholder and is not involved in the management decisions of your business.

Equity investors, on the other hand, may request a seat on the company's board of directors.

That means they will be involved in company decisions and have a say in the overall direction of the company.

Every type of financing has its own advantages and disadvantages.

Let’s go over them!

✔️Businesses can easily and quickly get substantial sums of capital through Debt Financing

✔️Debt Financing does not dilute ownership

✔️It can assist businesses in improving their credit scores

❌It must be repaid with interest, which can be rather expensive

❌If the company is unable to meet its payments, it may face bankruptcy

❌It may limit the financial freedom of the business by requiring regular payments regardless of financial performance

✔️Equity Financing does not force the business to repay the money as debt, which can be a relief for struggling businesses

✔️It can provide businesses with significant funding to help them grow

✔️It can assist businesses in attracting experienced investors who can offer advice and support

❌It dilutes ownership, which means you will give up some control of your company

❌Equity investors may have a say in how the business is operated, which can be difficult for entrepreneurs who are used to having complete control

❌Equity investors may anticipate a return on their investment, putting pressure on the company to perform well

As much as Debt and Equity Financing differ, they also have things in common, such as helping your business grow.

While Debt Financing is more of a classic loan arrangement, Equity Financing includes giving up your company shares for an investment.

Which is best for you is determined by a number of factors, including your company's financial health, ability to generate cash flow, and strategic goals.

If you want to give Debt Financing a go, you can check Myos financing options.

If you are a small business owner, you know the struggle of securing a loan.

Whether your traditional lending options may be limited due to a shorter operating history, inconsistent cash flows, or you don't feel like letting the control of your company to the third party.

Asset-based financing can be an advantageous choice because it allows you to leverage your tangible assets, such as inventory, equipment, or accounts receivable, to secure a loan.

It also often offers competitive interest rates and terms, making it an attractive choice for businesses looking to meet their working capital needs or invest in expansion opportunities.

Myos offers working capital loans from €10.000 - 2.5 million, through the following solutions:

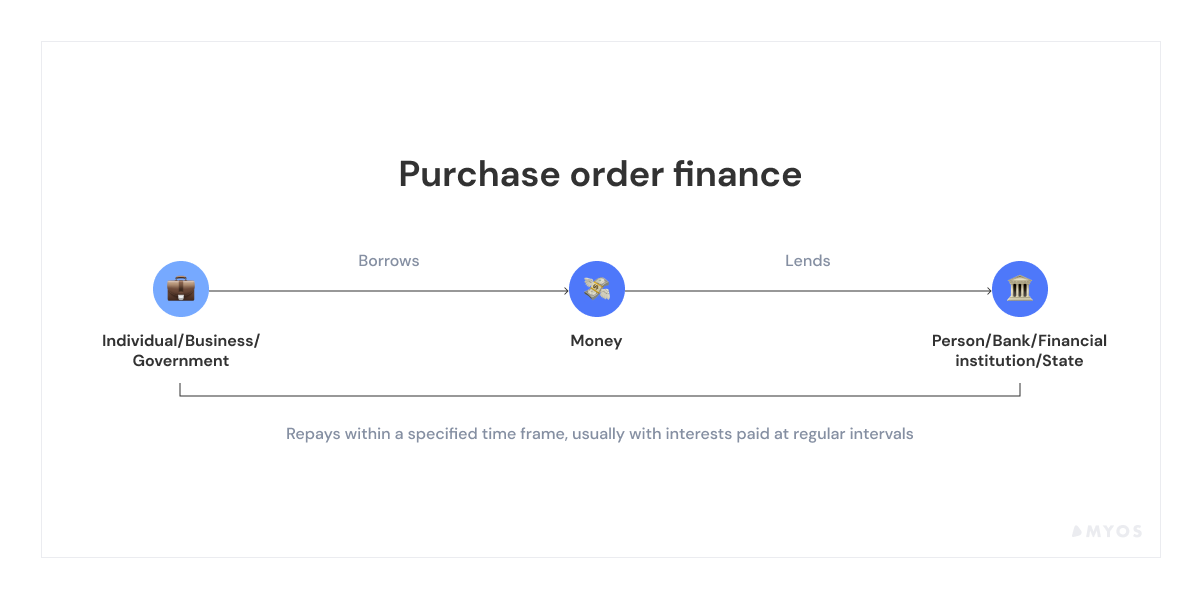

1. Purchase order financing - Boost your sales and maintain a steady inventory by ordering more from your manufacturer without worrying about deposit or balance payments.

With our support, you can ensure a seamless supply chain, all while accelerating your business growth and staying agile with access to extra working capital.

2. Stock Financing - Use your existing inventory for rapid access to growth capital. Our innovative approach employs AI to assess your products' market popularity rather than solely relying on traditional credit checks. We use only a portion of your inventory as collateral, eliminating the need for personal guarantees.

No matter what your needs are, we've got you covered!

Experience the perks of using Myos, including the following:

🚀 No personal guarantees are required, allowing you to focus on business growth.

🚀 Flexible repayment with no extra costs; payback within 12 months at your convenience.

🚀 No intermediary involvement with suppliers or customers, safeguarding your competitive edge.

🚀 Simple, online application process. There is no need for extensive financial analyses, annual accounts, or business plans.

🚀 Always accessible for personalized support through calls, chat, or email, and the option to meet in person.

🚀 Ensure sales growth and prevent stockouts, maintaining product visibility and cash flow stability with Myos financing.

Are you eager to learn more?

Sign up today and get a free, non-binding offer!

Equity Financing is suitable when you're uncomfortable with debt-related obligations and want to share the business's risk with investors. It is an excellent choice for startups or high-growth companies.

Debt Financing is appropriate when you want to maintain complete ownership control and can comfortably meet interest and principal repayments. It is a beneficial choice for businesses with a predictable cash flow.

Equity Financing increases the equity section of the balance sheet, while Debt Financing increases the liabilities section. It impacts a company's financial leverage and ability to attract additional investors.

Equity Financing tends to share risk with investors. In contrast, Debt Financing can increase a company's financial risk due to the obligation to repay loans, especially in economic downturns.

Purchase Order Financing vs Factoring - What’s the Difference?

Revenue-based vs Equity-based Financing - What’s the Difference?

Asset-Based Financing vs Revenue-Based Financing - Which To Choose